Is gold reversing course? 21 October marks the worst decline in recent years and surprises investors. What happened and why?

On Tuesday, 21 October, the price of gold fell to levels not seen in about 12 years. The event left investors around the world speechless: added to the extent of the loss was the shock caused by the fact that the value of the precious metal had been rising steadily for months. So? It’s time to analyse the facts.

The price of gold plummets: what happened?

In just over 24 hours, gold recorded its worst performance since 2013, losing almost 8.3% to reach $4,000, before rebounding and settling at a compound of writshock– in the range between $4,050 and $4,150.

An incredible figure that testifies to the magnitude of the event is related to the loss, in terms of market cap, of the most noble of metals: this -8.3% corresponds, give or take a million, to approximately $2.2 trillion or, to put it another way, the entire market capitalisation of Bitcoin.

The collapse of gold has also affected companies linked to the mining sector – some may notice interesting similarities. The two largest mining companies in the world, Newmont Corporation and Agnico Eagle Mines Limited, have in fact recorded sharp declines: from the opening of the stock markets on Tuesday 21st to the time of writing, the two companies are losing more than 10%.

Gold is not the only precious metal in trouble: silver is currently down 8.6%, while platinum, which is actually doing a little better, is down 7.2%.

The causes

If the price of gold is plummeting, as many analysts claim, the causes are mainly technical. In a nutshell, the sell-off could be a necessary consequence of the rally that, since January 2025, has seen the yellow metal gain more than 50%: quite simply, if an asset grows for a long time, it is likely that sooner or later someone will decide to take profits.

To this argument, which certainly carries weight given the rise in gold prices, two variables of a more political and economic nature could be added.

The first is related to the relationship between the United States and China, which appears to be easing: after the clashes on 10 and 12 October, which eventually triggered the worst sell-off in the history of cryptocurrencies, US President Donald Trump and Chinese President Xi Jinping are expected to meet in Seoul on 31 October. The conditional tense is a must because The Donald has repeatedly shown that he changes his mind at the drop of a minute.

Here is an example. On Tuesday 21st, the POTUS confirmed his intention to reach an agreement with the supreme leader: “I have a very good relationship with President Xi. I expect to be able to reach a good agreement with him,” but then added that the meeting “may not happen, things can happen, for example someone might say ‘I don’t want to meet, it’s too unpleasant. But in reality, it’s not unpleasant. It’s just business.” Pure unpredictability.

The second, on the other hand, could be understood in part as a consequence of the first: the strengthening of the US dollar. The DXY, which measures the value of the dollar against a basket of the six most important foreign currencies, has gained 1.3% since mid-September.

Is this a reversal of the trend or a temporary retracement?

Has the upward trend in gold come to an end, or are we witnessing a mere temporary halt? This is the question of questions, to which, of course, no one can answer.

What we can say, however, is that a change of course could be excellent news for Bitcoin. An interesting precedent can be found in 2020: when gold reached its market peak in August at £2,080, Bitcoin hit bottom at £12,250 – what times.

From that moment on, gold moved sideways for about three years before beginning an upward trend that saw it double in value, while Bitcoin embarked on the epic bull run of 2020-2021: from £10,000 in September 2020 to £65,000 in April 2021. A veritable rotation of capital in favour of the King of Crypto.

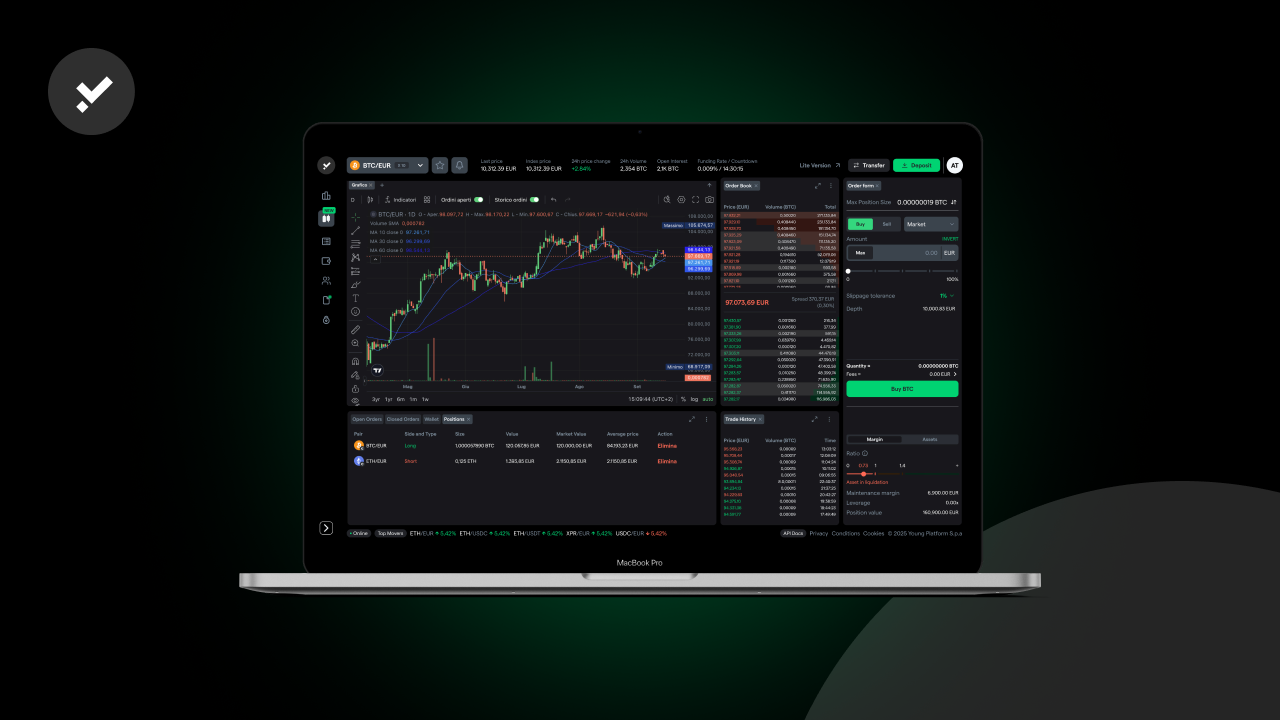

Citigroup assigns a strong ‘Buy’ rating to Strategy

In the event of a trend reversal, will the gold-BTC pattern repeat itself in 2025? Again, there is no way of knowing. However, banking investment giant Citigroup has officially started following Strategy (MSTR), Michael Saylor’s company that holds 640,418 BTC: its first recommendation to investors was ‘Buy’, forecasting a target price for the stock of £485.

The interesting thing is that Strategy’s share price – at the time of writing – is around £280: if Citi sets a target price of £485, it means that it expects the stock to grow by around 70%. Citi analyst Peter Christiansen, who is monitoring MSTR, said that such a price increase “is with its base case forecast over the next 12 months, set at £181,000, a potential upside of 65% from current levels“.

Gold and itcoin, neck and neck?

We’ll have to wait and see what happens in the coming weeks. The data tells us that, over the last three years, more and more financial institutions – central banks in particular – have started to stockpile physical gold, partly to protect themselves from the devaluation of the dollar, accentuated by the Trump administration’s management.

On the other hand, we are witnessing an almost daily increase in showbero entities, both public and private, that are deciding to include Bitcoin in their treasuries and that, generally, no longer see the asset as an alternative, but as a choice.

Finally, as always, we remind you that the information contained in this article is for informational purposes only. It does not constitute financial, legal or tax advice, nor is it a solicitation or offer to the public of investment instruments or services, pursuant to Legislative Decree 58/1998 (TUF). Investing in crypto-assets involves a high risk of loss – even total loss – of the capital invested. Past performance is no guarantee of future results. Users are invited to make their own informed assessments before making any financial and/or investment decisions.