As of January 31, gems will be reset and will no longer be used for purchasing fee discounts. Instead, they will play a key role in rankings, prizes, and competitions within the app.

The New Year is set to bring many surprises for you and the entire community. We are excited to announce contests and competitions that will enable you to compete against other users and win amazing prizes. The first of these initiatives will launch in February. While we can’t share too much just yet, we can reveal that Gems will play a central role in this challenge. Are you ready to participate?

Gems reset on all accounts.

As of January 31, all Gems will be reset to ensure that everyone starts at the same level in future competitions. This reset represents an opportunity to create a fair and exciting environment where every user has an equal chance to rank among the winners. With this change, the reward system will be more transparent and accessible, offering a refreshing new experience on the platform.

Before this change can happen, we must utilise the gems we have gathered so far!

Please note that competitions, prizes, and rankings will only be accessible in the app. If you haven’t done so yet, download Young Platform!

Download the app!

How to exploit Gems before 31 January

If you have accumulated Gems, now is the perfect time to use them! You have until January 30, 2025, to take advantage of the benefits. Here’s how:

- Redeem completed Quests: Log into the app and redeem all available Gems.

- Spend in the Shop: Use your Gems to purchase fee discounts and save on trading costs.

Remember to plan your budget: The fee rebates you buy in the Shop are valid for 24 hours, so ensure you have funds ready for trading. If necessary, make a deposit into your account before purchasing the discounts!

If you are a Club member and purchase a higher discount, the highest available discount will be applied. As a general rule, you can use the most beneficial discount available to you.

WARNING: All incomplete, unredeemed Quests and unused Gems will not be available after 31/01.

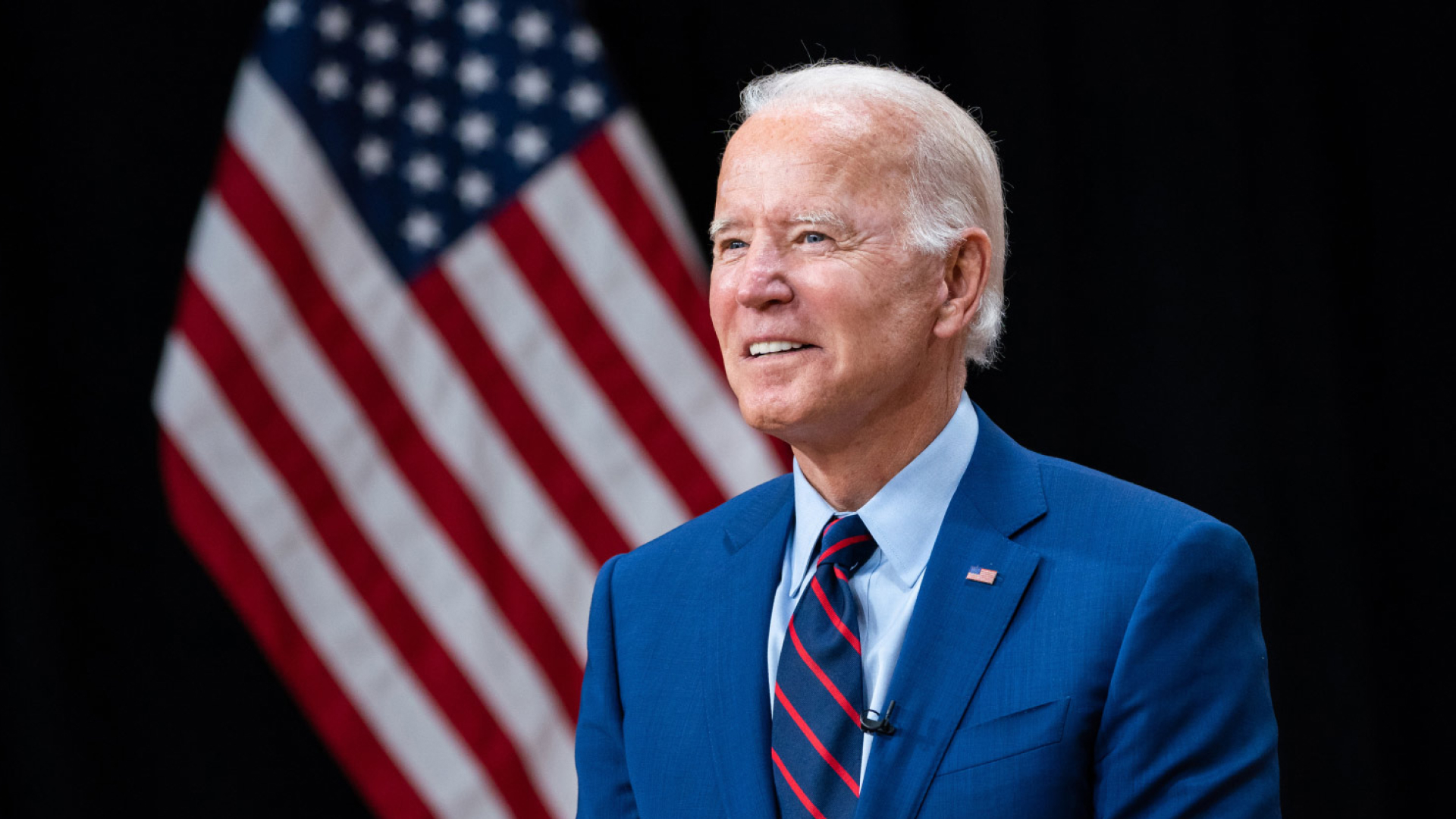

Why join a Club before February 4?

Lock in a 100% fee discount forever!

If you’re considering switching to Club Platinum or signing up, now is the ideal time to act! Starting January 4, Club Platinum will reduce the fee discount from 100% to 90%. However, anyone who signs up by February 3 will retain the benefit of a 100% fee discount forever, just like current Club Platinum members. For them, nothing will change, and they will continue to enjoy the 100% fee discount without any alterations.

Take advantage of this unique opportunity now! Read the in-depth article to learn more.

Please note: The discount remains valid as long as you continue to be a Platinum Club member.

Club price changes

Starting February 4, 2025, a new system for calculating club membership costs will be implemented based on the price of the YNG token.

If you join a club before February 4, you will lock in the current amount of YNG tokens required for membership. For instance, at today’s price of €0.15 per YNG, you could join Club Silver by using 5,000 YNG tokens, which is approximately €750. However, after the new pricing structure is introduced, you would need 8,000 YNG tokens to join Club Silver at the same price of €0.15 per token, resulting in a cost of €1,200.

For more details, read the in-depth article.

Prepare your 2025 on Young Platform!

Don’t miss the chance to make the most of the Gems and Club benefits before the changes. Sign up now, use your accumulated Gems and get ready to compete and win. 2025 on Young Platform will be a year full of opportunities!

Information regarding the YNG Token is for informational purposes only. The Token does not represent a financial instrument. The purchase and use of the YNG Token involve risks and must be carefully evaluated. This does not constitute a solicitation for investment, nor a public offering under Italian Legislative Decree no. 58/1998.