The 2024 calendar of must-see meetings

When will the next ECB meeting take place? The central bank’s calendar is constantly monitored not only by investors or market experts. Even ordinary Eurozone citizens follow the central bank’s meetings with interest and apprehension, as its decisions can affect households’ portfolios.

Therefore, every ECB meeting is eagerly awaited and preceded by countless predictions about Christine Lagarde’s and the Governing Council’s moves, whose words are constantly scrutinised. Here, then, is the 2024 calendar (and beyond) of meetings to monitor and attend all of the appointments with the Frankfurt institution.

You might also be interested in Deciphering the ECB: Interest Rates, Inflation and What it Means for You.

Next ECB monetary policy meeting: calendar 2024

The ECB’s annual calendar has several appointments. It generally meets twice a month, but monetary policy decisions are discussed only every six weeks. These are the most eagerly awaited meetings because they can influence the financial and other markets. The ECB calendar is, therefore, divided into two parts: the upcoming monetary policy meetings and the non-monetary policy meetings.

The first category of appointments, which always falls on a Thursday, is followed by the press conference of the institution’s president, Christine Lagarde, who presents what has been decided to the public and journalists.

What is discussed during each ECB monetary policy meeting? The main topics are generally Eurozone growth and GDP, quantitative tightening, inflation trends, and interest rates.

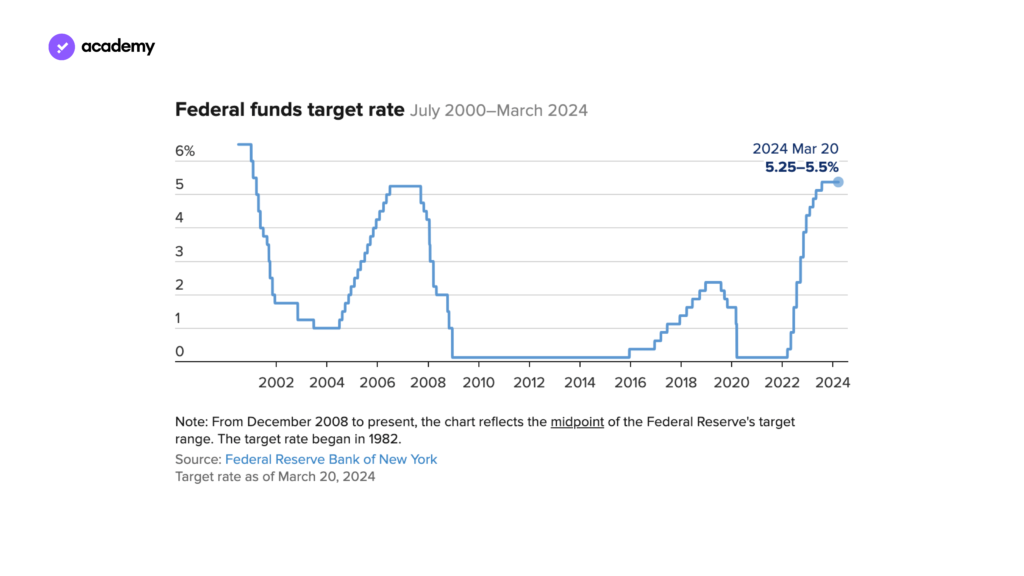

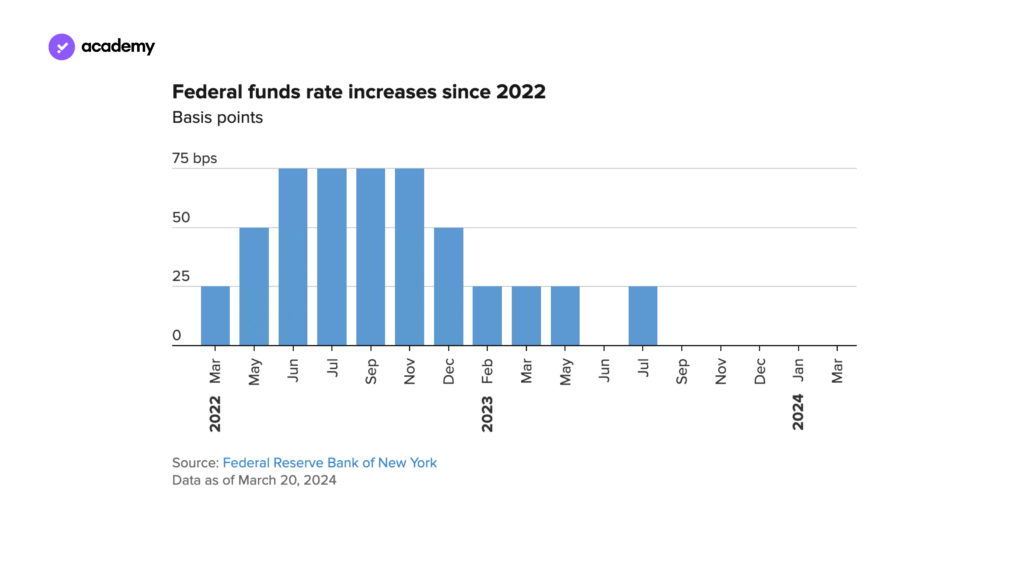

Interest rate decisions are significant because they directly impact people’s savings and purchasing power. Rising interest rates, for example, have various consequences, including rising mortgage costs. On the other hand, raising or lowering interest rates is essential for the ECB to fulfil its primary task of keeping prices stable.

The initial question arises: when is the next ECB meeting? Here is the 2024 calendar of monetary policy meetings:

- 25 January 2024 – Interest rates are maintained at their current levels

- 7 March 2024 – Another ‘no’ to the interest rate cut

- 11 April 2024 – Falling inflation in France and Italy: early interest rate cuts?

- 6 June 2024

- 18 July 2024

- 12 September 2024

- 17 October 2024 (at the Bank of Slovenia)

- 12 December 2024

Except for the October meeting in Ljubljana, every ECB meeting in 2024 will be held in Frankfurt and chaired by the Governing Council of the European Central Bank, the institution’s main decision-making body. This consists of President Christine Lagarde, Vice-President Luis de Guindos, four members appointed from among the leading Eurozone countries who hold office for eight years, and the governors of the national central banks.

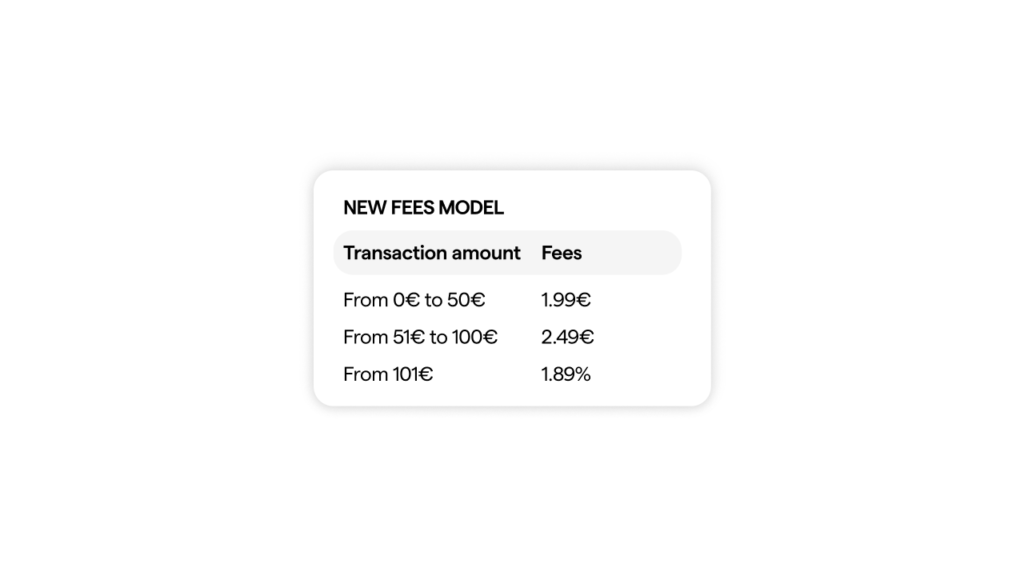

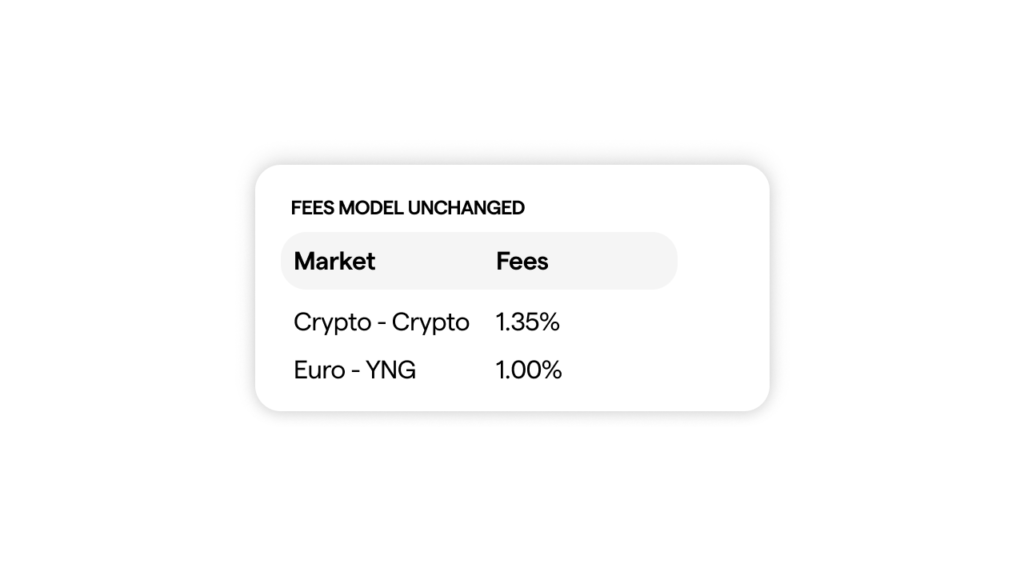

After each meeting, investors monitor the markets to gauge the reactions to the European Central Bank’s decisions. Some of these also impact the cryptocurrency market. Therefore, the upcoming ECB meetings, like those of the Fed (Fed calendar 2024), should be watched. On Young Platform, the leading cryptocurrency exchange, you can monitor cryptocurrency prices simultaneously as reports on each ECB meeting.

Discover Young Platform

Next ECB non-monetary policy meeting: calendar 2024

The ECB meeting calendar also includes meetings not dealing with monetary policy issues. On these occasions, the other tasks and responsibilities of the European Central Bank, such as banking supervision for the Eurozone, are fulfilled. Here are all the dates of the upcoming meetings:

- 21 February 2024

- 8 May 2024

- 22 May 2024

- 19 June 2024

- 1 July 2024

- 25 September 2024

- 13 November 2024

- 27 November 2024

The General Council also convenes another type of ECB meetings, which have advisory and coordination functions:

- 21 March 2024

- 20 June 2024

- 26 September 2024

- 28 November 2024

ECB meeting calendar 2023

To review past meetings and conferences, this is the calendar of every ECB monetary policy meeting held in 2023. Except for the October meeting in Athens, every ECB meeting in 2023 was held in Frankfurt.

- 2 February 2023

- 16 March 2023

- 4 May 2023

- 15 June 2023

- 27 July 2023

- 14 September 2023

- 26 October 2023

- 14 December 2023

So, the next ECB meeting in 20243 will soon occur, and all eyes are on the possible cut in interest rates. But this year’s calendar of meetings is complete, and there will be plenty of opportunities to discuss the Eurozone economy.