Immutable X is a layer-2 solution built on Ethereum, specialised for crypto gaming and NFTs. Find out all about the future of gaming!

Do you dream of playing video games like Skyrim or Fortnite but on the blockchain? Your dreams may soon become reality. Immutable X is a layer-2 blockchain built on Ethereum with low fees and no gas fees for NFT minting. Near-instant transactions and a marketplace with eye-catching graphics complete this ambitious project. The goal? To be the pioneers of crypto gaming and enable the development of games that rival the most renowned development houses. Find out what Immutable X is and how it works, and which video games are being developed on the crypto gaming blockchain!

What Immutable X is and how it works, the crypto gaming blockchain

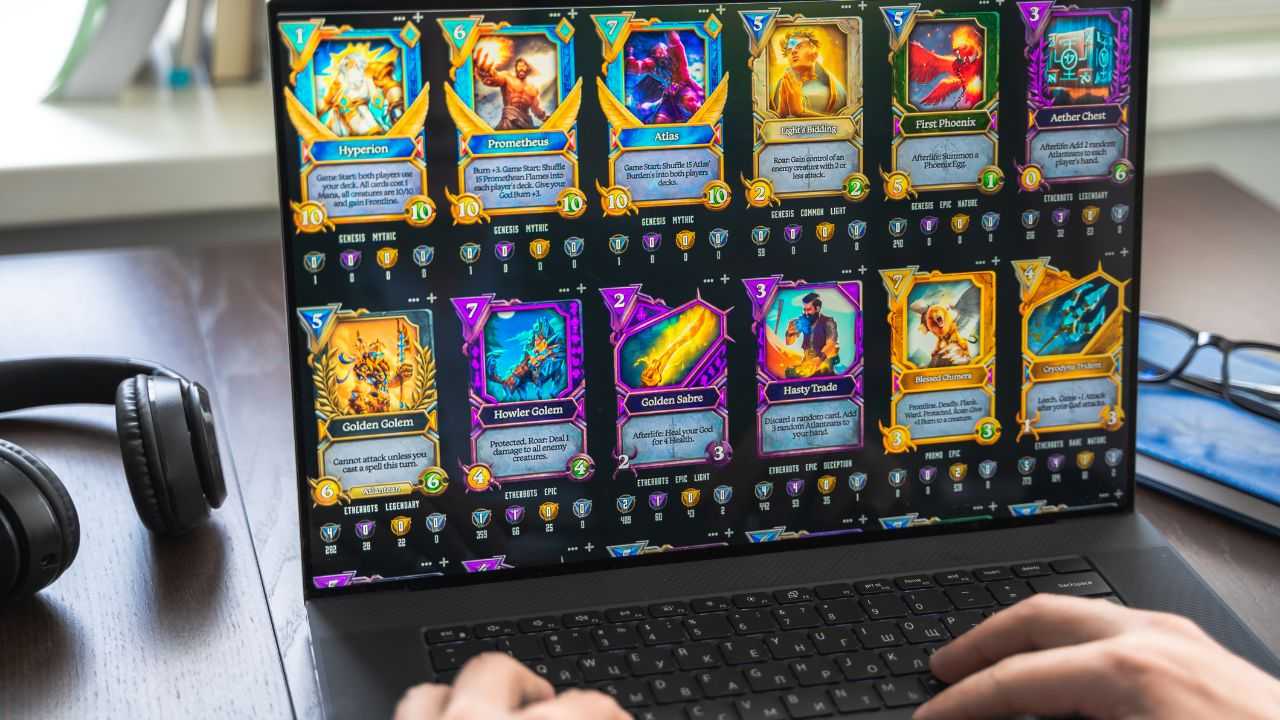

Immutable X is a blockchain developed by gaming studio Immutable. Founded in 2018, the company released Gods Unchained, one of the first collectible card crypto games to achieve success. The video game was initially based on Ethereum, but Immutable soon realised that Buterin’s blockchain was not ideal for a crypto game. Gods Unchained is based on the continuous exchange of cards between players. Therefore, an efficient and low-commission blockchain was needed to incentivise players to buy and sell cards in the form of NFTs.

The solution? Immutable X, a layer-2 solution that employs the latest technological innovations to guarantee instant and cheap transactions. Unlike Ethereum, Immutable X uses a zero-knowledge rollup system. In short, transactions are not executed one at a time but in batches, which are approved by a smart contract. This system can support up to 9,000 transactions per second. The technology is easy to apply even for budding game developers, so it is popular with developers approaching blockchain. Immutable X’s ZKs allow NFT and crypto to be exchanged at lightning speed, and players can focus on having fun!

IMX is Immutable X’s utility token, an ERC-20 with various uses within the blockchain. There are 2 billion IMX, and they are used both to pay fees and to give incentives to developers and creators. IMX is also a governance token, and gives the right to vote on decisions affecting the blockchain for crypto gaming. The beta staking of IMX started on 1 July 2022 and will last until 30 July. In September there will be a second test of self-custodial staking (i.e. staking without intermediaries). Immutable X chose this approach as a consequence of recent events in which some CeFi platforms blocked their users’ withdrawals. According to the Immutable X team, with IMX self-custodial staking, no one can ever block withdrawals, because Immutable X tokens always remain in the user’s possession.

Immutable X and the NFT marketplace

NFT or non-fungible tokens is the technology that has made crypto gaming a reality. In fact, thanks to them, it is possible to guarantee the uniqueness of certain objects in a user’s possession and consequently their value.

To make the user experience as simple as possible, Immutable has decided to focus on an NFT marketplace integrated on the blockchain. Unlike Ethereum, NFTs on Immutable X do not require gas fees to be mined, incentivising players and developers to use the GameFi ecosystem. Transactions are immediate and without the long wait times that Vitalik Buterin’s blockchain has accustomed us to, and they also consume very little energy. Mining the 8 million NFT cards for Gods Unchained on Ethereum would have required 490,000 mWh of energy, while only 1,030 kWh were needed on Immutable X!

In addition, Immutable X aims to simplify the buying and selling of NFTs with a simple and attractive proprietary wallet. At the moment, the wallet of choice is the popular MetaMask, but the Australian crypto gaming blockchain company plans to create a wallet designed specifically for gamers and integrated with major credit cards and Immutable X’s NFT marketplace. This will allow you to get into the thick of the game in the blink of an eye, even if you are not an expert in crypto and blockchain. Simplicity is a key factor in making the crypto games of the future mainstream!

AAA crypto games to hit the blockchain

Immutable X’s commitment to creating an easy-to-use, player-centric ecosystem can be seen in the growing number of crypto games that choose it as their blockchain of choice. Illuvium and Ember Sword, two video games that promise to be a hit in the industry, have chosen Immutable X to support their game economy.

The company behind the crypto gaming blockchain has also decided to launch a $500 million fund for game developers. This money aims to support all those who want to help build the Web3 and increasingly affordable NFT platforms. Robbie Ferguson, CEO of Immutable, noted that the total value of the crypto gaming market is approaching $1 trillion! “This is just the tip of the iceberg in an industry with enormous potential,” said the company president.

Now you know what Immutable X is and how it works, get your joystick ready: crypto games that are no match for the likes of Skyrim or GTA are coming soon! Star Atlas, Illuvium, Ember Sword and many other games are in development and will be released soon. And if hunting for digital monsters is not enough for you, Immutable X’s NFT marketplace offers plenty of tokens for all tastes. The future of crypto gaming is already here!