The Phantom crypto wallet becomes compatible with Ethereum and Polygon, NFTs can now be bought on Uniswap and Brazil legalises crypto

Now that December is here, people are starting to think about Christmas presents. In case you’ve been thinking about gifting an NFT over the last week, you can now also buy one on Uniswap, thanks to its brand new NFT marketplace aggregator. The second news of the week concerns Phantom, Solana‘s main crypto wallet, which is also arriving on the Ethereum and Polygon networks. If, on the other hand, the cold December weather has already tired you out and you are considering moving to Brazil, there is some good news. The South American state has approved a legislative decree on cryptocurrencies!

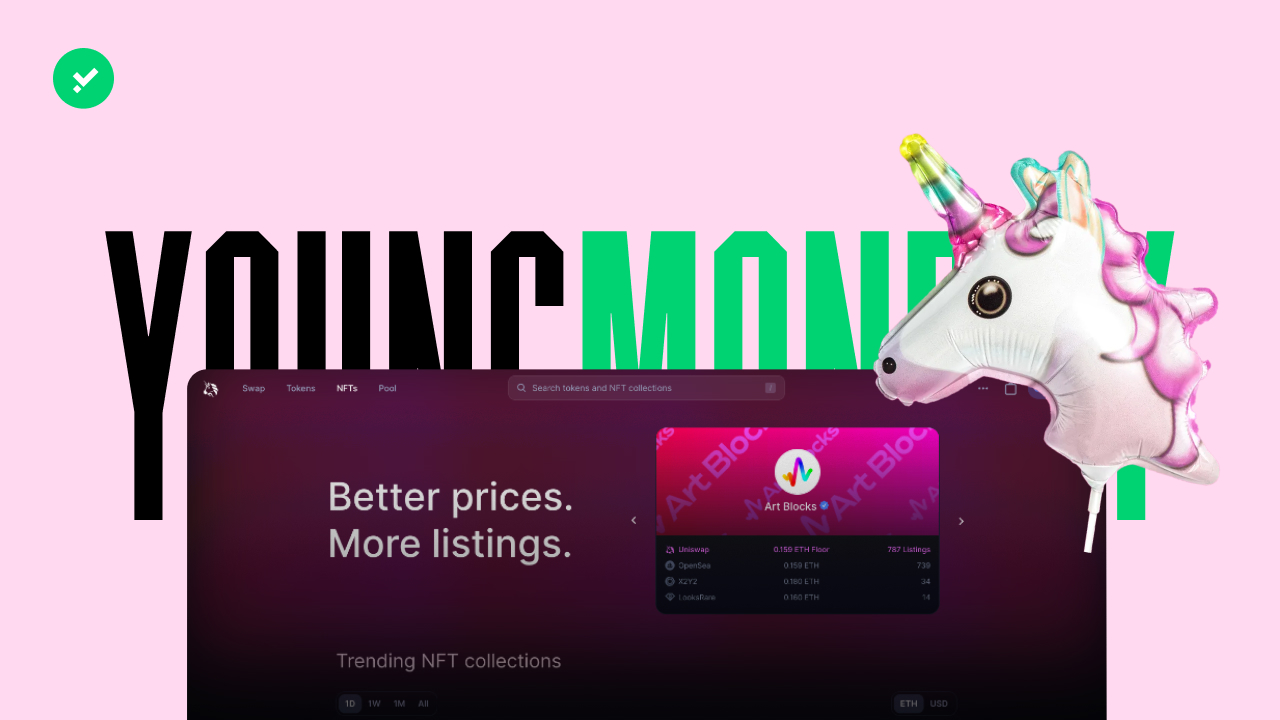

On Uniswap you can now also buy NFTs!

Since the 30th of November, NFTs have officially arrived on Uniswap. The announcement for the initiative came in June, when the first decentralised exchange (DEX) in history announced the acquisition of the NFT marketplace aggregator Genie. An NFT aggregator is a decentralised application (dapp) that is responsible for showing users different alternatives for purchasing the same token on different trading platforms. Uniswap will gather data from Looksrare, OpenSea, X2Y2, Sudoswap and others that are yet to be announced.

In order to welcome NFT collectors to its platform, Uniswap has decided to apply discounts on gas fees. The first 22,000 wallets to purchase an NFT will benefit from a discount of 0.01 ETH (approximately $10) on their first transaction.

The news about Uniswap and Genie does not end there. Those who used Genie before the 15th of April 2022 (included) could be in line to receive a nice Christmas present. The NFT aggregator plans to distribute an airdrop to its early adopters. 300 USDC will be distributed to those who completed more than one transaction on the NFT aggregator, and 1,000 USDC to those who held a genesis Genie NFT on the 15th April 2022.

Phantom is also ready to integrate Ethereum and Polygon

The Phantom crypto wallet, created in 2021 on Solana, will soon also integrate the Ethereum and Polygon blockchains. Phantom was created by the same developers who started the 0x DEX, with the aim of competing with MetaMask. However, instead of creating a crypto wallet for Ethereum, the Phantom team opted for a nascent ecosystem. The choice fell on Solana, and it can be said to have been a good one. Indeed, the crypto wallet has reached 3 million users in less than two years.

Now, Phantom is finally ready to arrive on Ethereum and Polygon, bringing with it the ease of use that has characterised it since its inception.

One of the upcoming innovations for Phantom, presented by CEO Brandon Millman, is the display of all tokens and cryptos in one screen, even if they are on different blockchains. This could be a very useful function for those who hold the same crypto in different networks and want to have an overall view of their funds. A further improvement for Phantom, again according to Millman, are cross-chain crypto and NFT exchanges from within the same wallet. The feature is being introduced so that users can move their assets from one blockchain to another without having to rely on complicated bridges.

Brazil’s crypto legislation

Brazil has reached a turning point in crypto regulation legislation. The crypto assets bill was voted by the Chamber of Deputies on Tuesday the 29th of November and will shortly arrive on Brazilian President Jair Bolsonaro’s desk, waiting to be signed.

Brazil’s new cryptocurrency law provides for a licence for exchanges wishing to operate in the crypto market. It also stipulates that assets on blockchain that are considered securities will be regulated by the Commission for Securities and Exchanges (CVM), while assets that do not fall into this category will be the responsibility of the Brazilian Central Bank. To better understand the role these state bodies play, you can make a parallel with the US. The Brazilian CVM plays the same role as the Securities and Exchange Commission (SEC), while the Central Bank plays that of the Federal Reserve (FED) of the United States.The adventure of this legislative decree began some time ago, in April 2022 to be precise, when it was approved by the Senate. However, the vote in the Chamber of Deputies took longer than expected due to the discussion of a very topical issue: the way in which exchanges store users’ funds.