The Bitcoin Policy Institute has proposed Bitcoin bonds, an innovative financial instrument that guarantees good returns without risk. Learn more about it.

Bonds based on Bitcoin may soon become a reality. The Trump administration’s favourable stance towards cryptocurrency is evident and has been demonstrated at various times, particularly with the approval of government reserves in Bitcoin.

Recently, however, discussions have emerged regarding an innovative financial development: a new method for integrating Bitcoin into the global financial system. Could BTC potentially serve as one of the pillars supporting U.S. debt through “Bit Bonds”? How do these instruments work?

US debt rises and worries.

The proposal to introduce Bitcoin-backed bonds has emerged in response to the growing US public debt, which has steadily increased relative to the GDP since the pandemic began. Naturally, when a problem becomes acute, the search for solutions accelerates. In this case, that could lead to the launch of Bitcoin-backed bonds.

Bitcoin does not fully collateralise these bonds; they are financial instruments that include a strategic allocation to cryptocurrencies. The fundamental concept is quite ambitious, so we find it appealing. The idea is to enhance virtually risk-free financial instruments with a digital commodity, creating a net benefit for both governments and investors.

Buy BTC!

How Bit Bonds Work

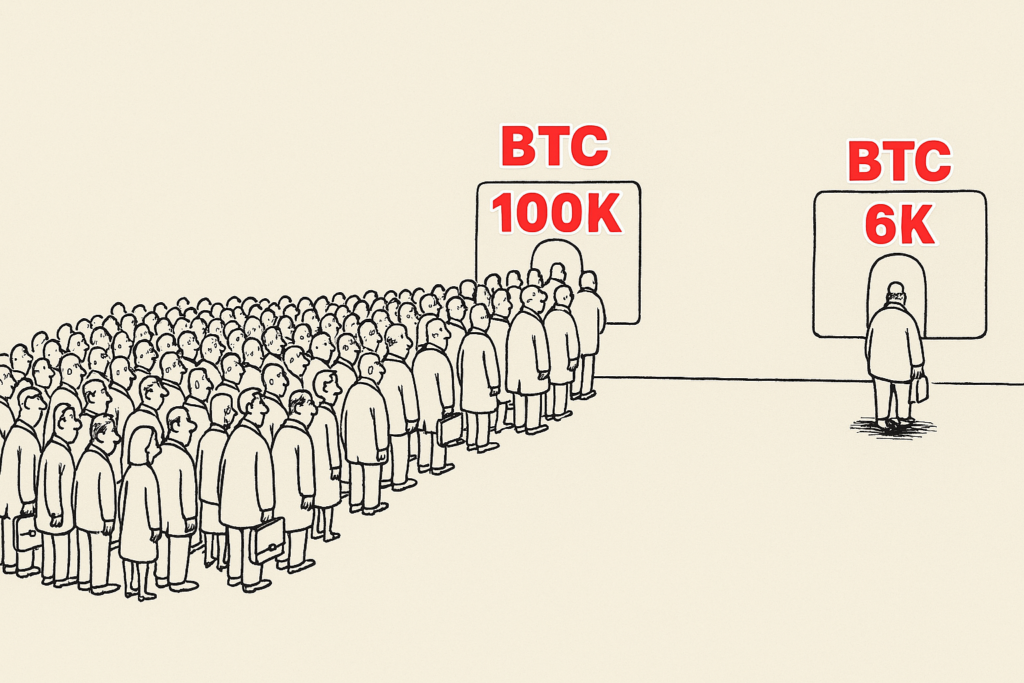

Bit Bonds function similarly to traditional US government bonds. They are essentially Treasuries—debt securities issued by states to raise funds at a lower interest rate (coupon rate) than the market average. The yield on these financial instruments is lower not because they are inefficient but because a market segment that accommodates Bitcoin must be created.

The interest—or yield—is lower because part of the money raised through these bonds is invested in Bitcoin. As Bitcoin’s value increases, it could positively impact the bonds’ interest.

As you can see, the theoretical framework for how Bit Bonds work is straightforward and advantageous for both parties involved: the state and the investors. Since the rate associated with these bonds is lower, the state saves billions of dollars in interest payments on debt. At the same time, investors gain indirect exposure to Bitcoin (BTC), an asset historically appreciated over the long term.

Why are they not risky financial instruments?

The most interesting thing about Bitcoin bonds is that they are not risky. Rather, they have the same degree of risk as government bonds. How is this possible? The price of Bitcoin does not always rise, so there must be some risk associated with it.

False! Every time a new Bit Bond is issued, a small part of the capital raised is used to buy Bitcoin, which is then locked in a separate pool. At the bond’s maturity, you receive back all the initial capital (principal), just like when you buy a normal bond. In addition, if the price of BTC has increased, you will receive an extra payment proportional to the increase.

This means that your investment is unpacked in two: a fixed tranche (typical of government bonds) and a variable tranche that follows the price trend of Bitcoin. Similar instruments such as TIPS (inflation-linked bonds) or gold-linked ones exist.

However, as historical data shows, Bit Bonds incorporate higher volatility and a much higher expected return. The reason? The price of Bitcoin has always experienced soaring bullish movements in every market cycle, whereas the fluctuations that gold or inflation are subject to are much smaller.

This makes Bit Bonds more attractive for the state, which can afford lower interest rates, and for the investor, who can obtain a return similar to that guaranteed on average by the stock market (around 10 per cent) and a minimum degree of risk.

Buy BTC!

How much could the US save thanks to ‘Bit Bonds’?

According to some estimates, refinancing $2 trillion of debt with Bit Bonds at 2% instead of 5% would save the US government about $700 billion over 10 years. These savings could lower some debt, finance public programmes, or make infrastructure investments without raising taxes.

The key concept behind Bit Bonds is familiar to anyone interested in the investment world: the asymmetry between risk and return:

- In the worst-case scenario, Bitcoin does not go up, but the government still pays less interest.

- In the best case, Bitcoin will rise, and the state will collect extra income to repay the debt.

This structure is not very different from many structured products already used in traditional finance, in which a low-risk asset is combined with a more volatile one to create a profile with a more favourable risk-return balance.

Moreover, pension fund issuers, insurance companies and sovereign wealth funds are often reluctant to invest directly in cryptos. But if rating agencies were to classify Bit Bonds as ‘quasi-risk-free’ (because the state guarantees the principal), these instruments could enter institutional portfolios.

In short, for the retail investor, Bit Bonds could be the perfect gateway into the crypto world. They don’t require wallet setup or the vagaries of custody. They’re just like government bonds but with an edge.

In an era of trillion-dollar deficits and a total lack of fiscal discipline, Bit Bonds offer an innovative solution: harnessing the growth of Bitcoin to ease the burden of interest and lower (at least some of) the national debt.

One thing is sure: if even part of this idea becomes a reality, we could be at a turning point. In a few years, we might say, “This is when everything changed.”