The complete 2024 Fed meeting schedule with all upcoming dates

The Federal Reserve System (Fed) meeting schedule, i.e., the central bank of the United States, has eight annual conferences. These meetings are the equivalent of the meetings of our ECB (here, it is calendar 2024), where monetary policy decisions are made. They are widely followed events because they can influence the course of the financial markets and, in recent times, have become real turning points for the future of the global economy.

Fed meetings: what is decided and by whom

Before discovering the 2024 Fed meetings calendar, let us see how these appointments work.

The FOMC (Federal Open Market Committee) is the Fed’s operating body and mouthpiece and chairs the meetings. This is comprised of 12 members, including US central bankers and the Fed Chairman.

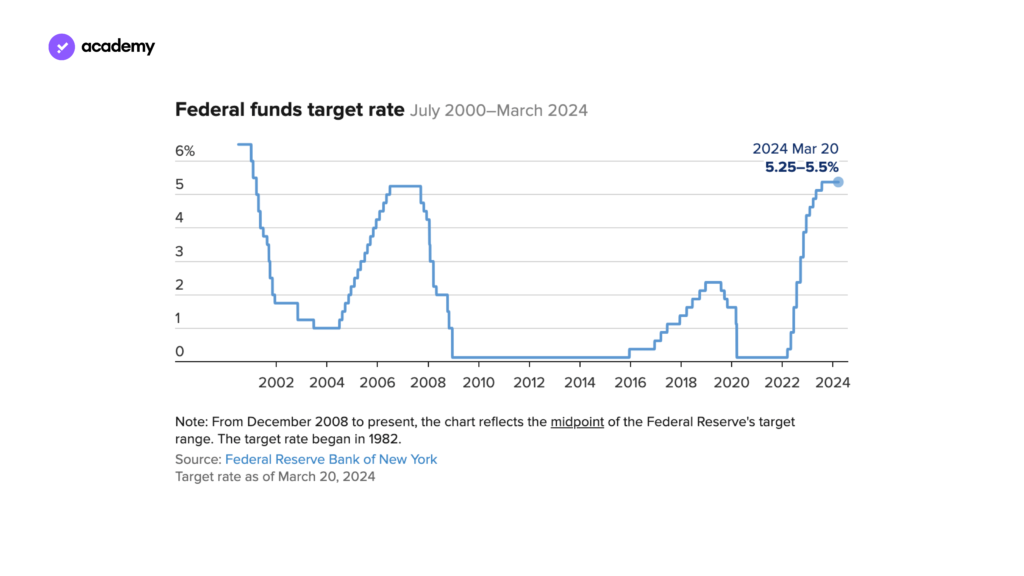

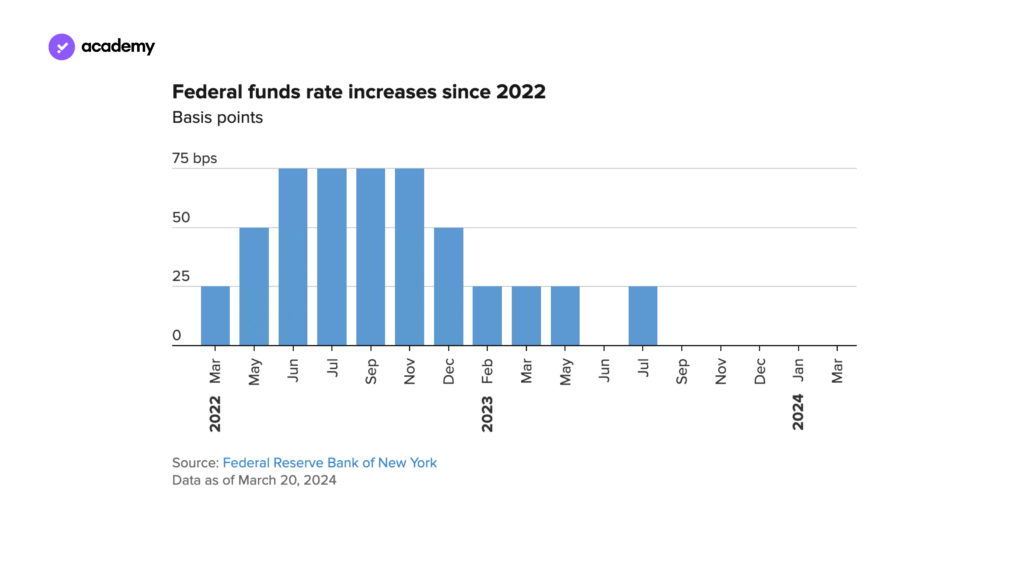

The FOMC assesses the financial conditions and monetary policy actions needed to achieve US economic objectives. The interest rate decision was the most decisive factor in this high-inflation period.

At each Fed meeting on the calendar, a summary of economic projections and the Dot Plot, a chart showing each Fed member’s anonymous forecast of the Fed funds rate position for the past year, the future and the long term, are presented. These appointments are highlighted in the calendar with an asterisk.

Here is an example of a Dot Plot chart published at the December 2022 Fed meeting.

Fed meetings scheduled for 2024

These FOMC meetings are held eight times a year, last two days, followed by a press conference by Chairman Jerome Powell. Here is the Fed calendar of all meetings for 2024.

- 30-31 January 2024 – Unchanged Rates

- 19-20 March 2024 * – Forecast

- 30 April – 1 May 2024

- 11-12 June 2024 *

- 30-31 July 2024

- 17-18 September 2024 *

- 6-7 November 2024

- 17-18 December 2024 *

Fed meetings scheduled for 2023

The Fed in 2023 met on these dates:

- 31 January – 1 February 2023

- 21-22 March 2023 *

- 2-3 May 2023

- 13-14 June 2023 *

- 25-26 July 2023

- 19-20 September 2023 *

- 31 November-1 December 2023

- 12-13 December 2023 *

Fed meetings scheduled for 2022

The Fed in 2022 met on these dates:

- *25-26 January 2022

- 15-16 March 2022*.

- 3-4 May 2022

- 14-15 June 2022*.

- 26-27 July 2022

- 20-21 September 2022*

- 1-2 November

- 13-14 December 2022*

Financial players and analysts await the Fed meetings with great interest. The Institute’s decisions play a major role in US monetary policy, but not only that. On several occasions, we have also seen an impact on other markets, such as the cryptocurrency market. That is why keeping an eye on the Fed’s calendar of upcoming meetings can be helpful.

You are currently on the Young Platform blog. Keep yourself updated with macroeconomic events directly on the app and observe their real-time impact on cryptocurrency prices.