Buy and Hold is a widely used long-term approach. It is based on the belief that, despite market volatility, the value of cryptocurrencies will tend to increase in the long run. Think, for example, of someone who bought Bitcoin five years ago and has yet to sell it, hoping for further appreciation.

Buy and Hold: General Considerations

Buy and Hold is a particularly suitable approach for beginners because it does not require excessive analysis skills or in-depth knowledge of market dynamics.

On Young Platform, we have developed a feature to use this approach: Moneyboxes. To be able to activate them, these are the elements you need to bring with you:

- a lot of patience

- a budget to be allocated on a weekly or monthly basis

- a basic grounding in the options available

For this last point, please refer to the end of the article.

Discover it on Young Platform

Why choose the buy-and-hold approach

Each approach has peculiarities that, aligned to the specific needs of each, can turn into significant advantages. Let us take a closer look at the conditions under which Buy and Hold can be particularly suitable:

- when one has little time or knowledge in the field

- when you can set aside a budget regularly (the minimum is 20€ in the case of Young Platform operations)

- one has an anxious, emotional or high-stress personality

- one is not too familiar with the use of applications or web platforms

- you do not want to achieve goals in the immediate term, but you are thinking of achieving results in the long term

- one does not know the charts well and finds it hard to understand what is the best price to buy and when is the best time to buy

Advantages of the Buy and Hold Approach

Less emotional impact

One of the most challenging aspects of buying cryptocurrencies is managing emotions. Market volatility can often lead to hasty decisions based on panic or euphoria. Buy and Hold reduces this emotional stress, as the user does not have to worry about daily market fluctuations.

Long-term benefit

Historically, many cryptocurrencies have shown a long-term appreciation trend. People who bought Bitcoin or Ethereum in their early years and held the position have often seen strong results. Of course, we know that ‘what has been‘ is no guarantee of ‘what will be’. However, looking at a chart that photographs the performance of a cryptocurrency from its inception to the present can help us understand whether a long-term approach has the best chance. This means the answer is ‘yes’ for one cryptocurrency and ‘no’ for another.

Simplicity of management

Unlike active trading, which requires constant attention and analysis of the market, the buy-and-hold approach is relatively simple to manage. Once the repetitiveness of buying is set, the user only has to monitor the market occasionally.

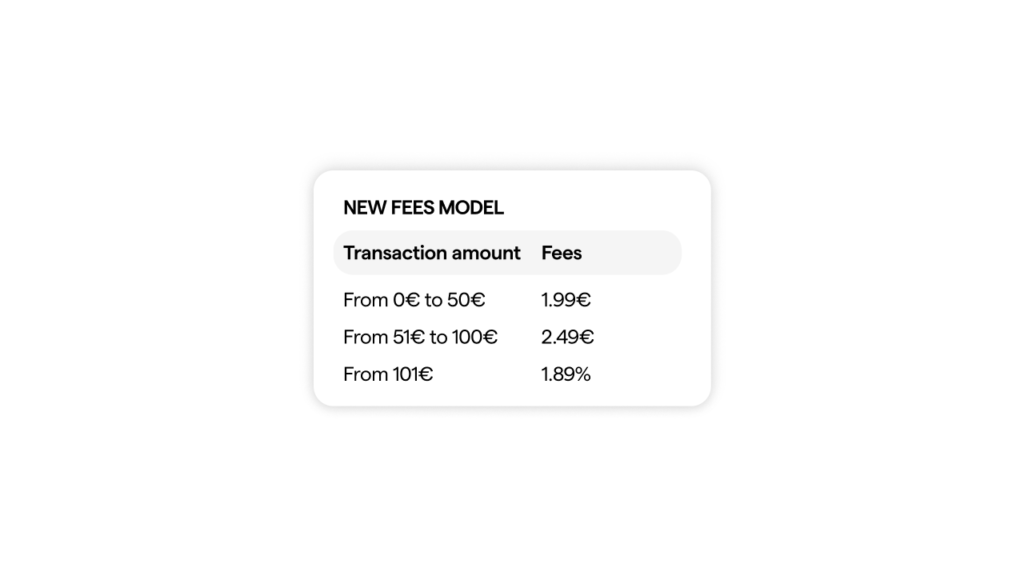

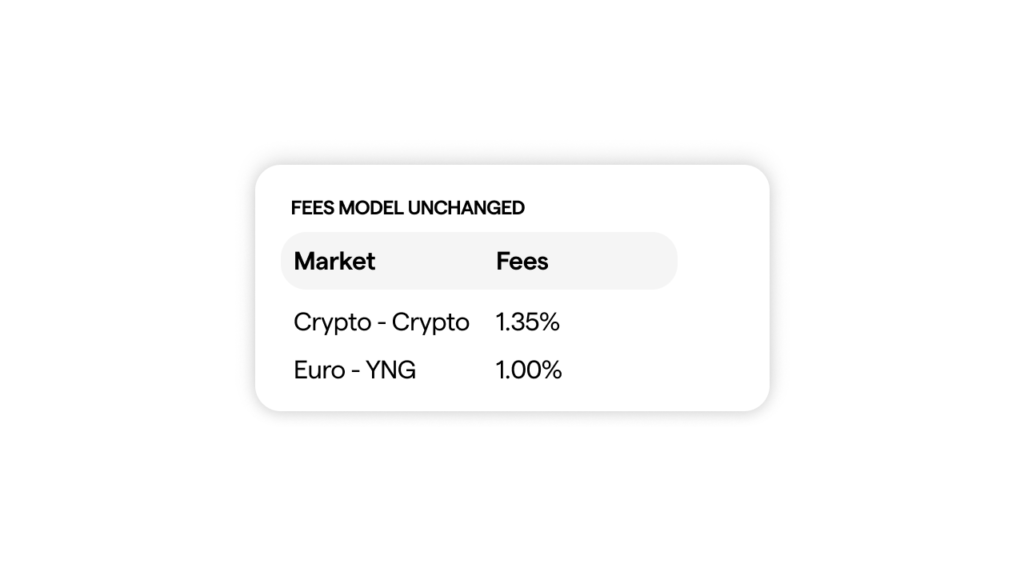

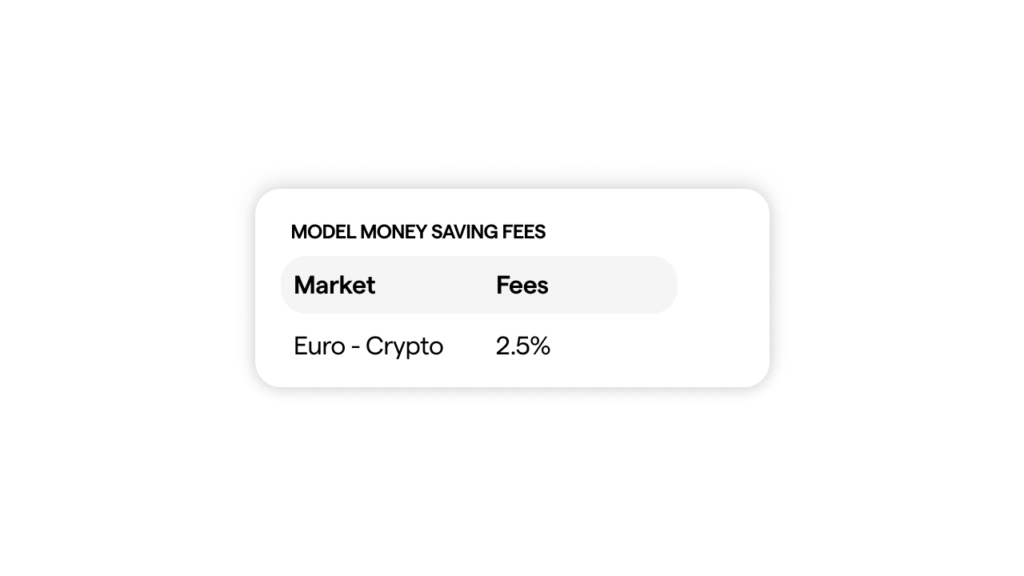

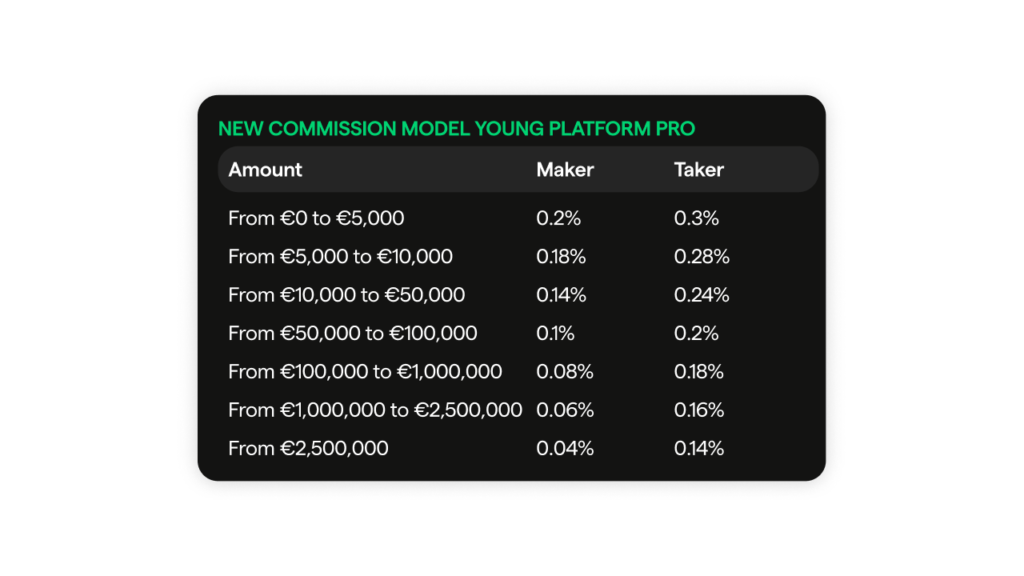

Reducing transaction costs

Each transaction may involve costs, such as buying and selling commissions. The buy-and-hold approach minimises the number of transactions, thus reducing the associated costs.

Flexibility of market entry

Systematic hoarding, also known as Dollar Cost Averaging, allows users to enter the market at an average cost, reducing the risk of buying large amounts of cryptocurrency at an unfavourable time.

More excellent protection against short-term volatility

By holding cryptocurrencies for an extended period, users are less exposed to the inevitable short-term market fluctuations, which can often be drastic.

How to apply this approach

Young Platform has developed an ad hoc section for this type of user: Moneyboxes.

Each Moneybox comes with a powerful tool: recurring purchases.

The recurring purchase is an automatic order executed according to our chosen settings.

There are three parameters to be entered:

- The budget

- Frequency

- The cryptocurrencies we are interested in

Choice of budget

The easiest way to decide on a budget is, for example, to analyse our expenses monthly. How much can we put aside? And how much of this budget do we want to convert into cryptocurrencies?

All that remains now is to decide how to load the budget into our account: by credit card, debit card, prepaid card or bank transfer. Follow the deposit guide for a complete tutorial on the procedure.

NB. When setting the recurrence of the deposit, make it a few days earlier than the one you set for the Moneybox.

Frequency

Once the budget has been established, all that remains is to ‘unpack’ it into several purchases. The choice can fall on:

- 1 purchase per month

- 1 purchase every fortnight

- 1 purchase per week

The choice will also depend on the size of the budget. For example, if it is 1,000€ per month, I may consider splitting it into several purchases so that the average purchase price is well spread over the 30 days.

Essential preparation on available options

Three types of Moneyboxes are available on the Young Platform. Each includes one or more cryptocurrencies, and knowing what we buy is essential. For an informed choice, it is crucial to learn more about the characteristics of each cryptocurrency, such as its history, market positioning and potential applications.

The Curated Bundle

These are Moneyboxes already diversified by market area:

- Popular: these are the most popular cryptocurrencies among members of the Young Platform community. Inside, you will find:

- Metaverse is an online virtual environment where users interact in shared experiences. Inside, you will find cryptocurrencies that belong to projects in the Metaverse:

- Web3 is the third evolutionary phase of the internet, characterised by blockchain-based economic and technological systems. Here, you will find the cryptocurrencies that collaborate in the construction of Web3:

- Proof of Work: includes the most popular cryptos that are based on this consensus protocol:

- Smart Contract: includes the most popular cryptos that use smart contracts

- DeFi comprises blockchain-based financial solutions that operate in a decentralised manner. Here you will find:

- Layer 2: these are state-of-the-art blockchains that seek to improve certain technology features. Here you will find:

Single Coin Moneybox

To purchase an individual cryptocurrency, simply select one from the menu. To explore the various projects, scroll down the Markets page of our site and, by clicking on a cryptocurrency’s name, read more about it. Before making any transactions, conducting thorough research and analysis is essential, assessing each cryptocurrency’s characteristics.

The Bespoke Bundle (2 to 5 crypto)

You can create a customised and diversified Moneybox using the’ Markets’ page to discover the various cryptocurrencies. This section lets you learn more about the available projects and their characteristics. However, conduct in-depth research on each cryptocurrency before including it in your Moneybox.

Young Platform does not provide tax, investment or financial services and advice. The information on this website is provided for informational purposes only. It is presented without regard to any specific individual’s objectives, risk appetite or financial circumstances and may only be suitable for some Users. Buying and selling cryptocurrencies involves risks, including total loss of capital. Users should always research, consult a qualified professional before deciding, and carefully assess their risk profile and loss tolerance.