The Q4 2024 report on the YNG token. What happened during this eventful year full of new developments? What are the following steps to take?

What happened in the last quarter? What objectives were achieved in 2024? What does 2025 hold for us—a crucial year for our future? How many YNG tokens were issued, bought, and sold, and what next steps should we take?

2025 will be a pivotal year

Before exploring the Young (YNG) token, the Clubs, and our ecosystem, it’s essential to clarify a few key points. We are entering the era of Composable Finance, a transformative period in which modularity and decentralisation are reshaping the financial system to be more inclusive, transparent, and flexible. Young Platform is well-suited to this landscape, as we have always aimed to simplify the crypto market for everyone, breaking down barriers and providing increasingly innovative and secure tools.

As mentioned earlier, our primary goal for 2025 is to establish ourselves as a crypto bank—a digital hub that combines the best of traditional finance (TradFi) and decentralised finance (DeFi).

Young Platform Club Numbers – Q4 2024

YNG is Young Platform’s utility token. It grants access to Clubs, subscription plans that offer exclusive benefits on our crypto services, and a curated selection of brands designed to enhance every aspect of life.

Currently, the Clubs consist of 1,882 members, distributed as follows:

- 1,276 in Bronze Club (+8%)

- 275 in Silver Club (+22%)

- 169 in Gold Club (+29%)

- 162 in Platinum Club (+22%)

Club Pricing: The New Model Comes into Effect

Users must purchase and lock a specific amount of YNG to join a Club on the Young Platform’s exchange. This amount has been permanently fixed until now, but as of today, February 4, 2025, it will become variable. This change aims to create a better balance between supply and demand, providing users greater flexibility. This report provides all the details regarding the new Club rebalancing mechanism.

Membership Growth in January 2025

The number of registered members is a crucial metric for analysing token distribution. As more people join the Club, more YNG tokens are locked, reducing the circulating supply. This dynamic contributes to YNG’s excellent price stability.

Club membership has increased compared to the previous quarter, likely due to the announcement of the 2025 Roadmap and the recently implemented rebalancing mechanism for the number of YNG required to join.

Starting today, the fee discount for new Platinum Club members who join the loyalty program will be 90% instead of the previous 100%. However, this change does not affect existing members whose terms and conditions remain unchanged.

As of the end of Q3 2024, club membership reached 1,659, reflecting an approximate growth of 13%, a rate not seen in the past two years. Additionally, it is encouraging to note that the most exclusive clubs, Gold and Platinum, experienced growth rates of 29% and 22%, respectively.

YNG Token Distribution

In October, the circulating supply of YNG tokens was approximately 23.7 million. By January, this figure had risen to 23.9 million, marking a net increase of around 107,587 tokens, or +0.8%.

The tokens were distributed through various mechanisms:

- 19,281 tokens were allocated for completing Quizzes, Challenges, and the Up&Down feature (before the Levels introduction).

- 43,797 tokens were earned by completing Levels.

- 44,509 tokens were distributed through the Staking feature.

The YNG token market is managed by an algorithm that determines the exchange rate based on two underlying liquidity pools denominated in EUR and YNG. At launch in May 2022, these pools contained:

- 1 million euros

- 4 million YNG

Taking into account token purchases and sales over the past few months, by the end of December 2024, the pools contained:

- 676,750 euros

- 6.27 million YNG

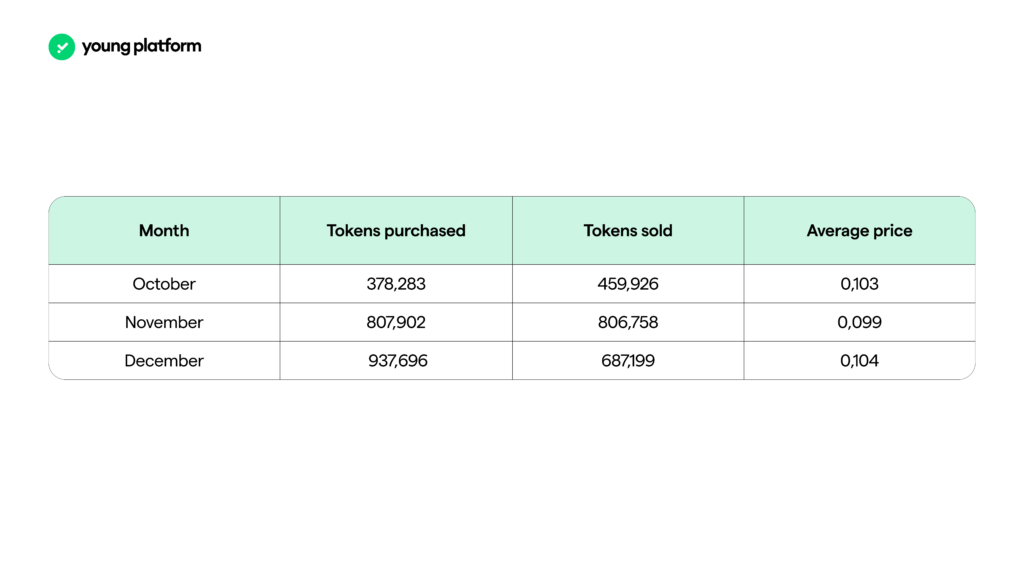

This configuration reflects the buying and selling activity during Q3, summarised below, along with price trends.

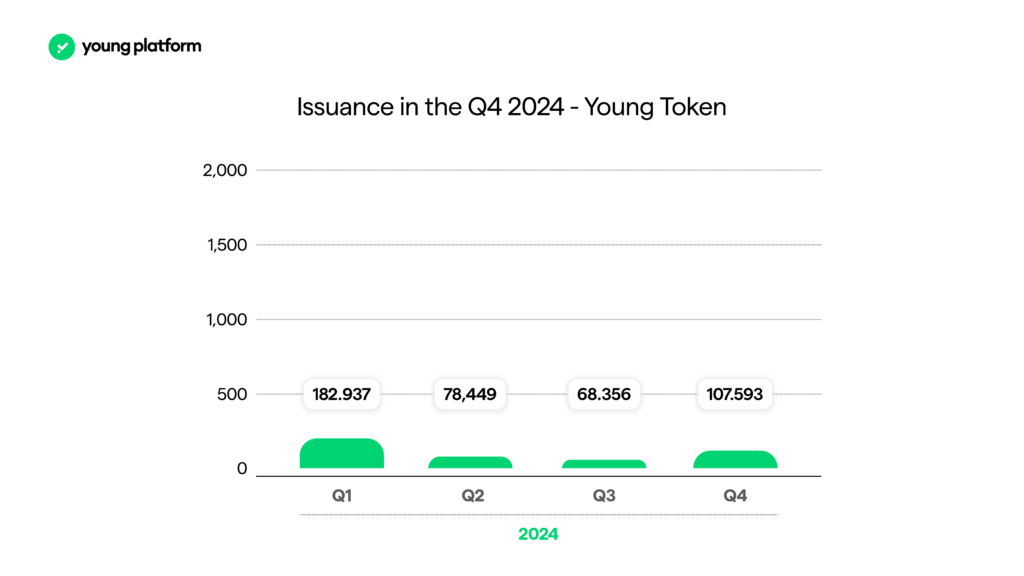

What happened in 2024 from a tokenomics perspective?

The token issuance mechanisms already changed in 2023 with the Step 3.0 update and, more recently, with the introduction of Staking.

The current number of YNG issued has risen by 57% compared to the 68,000 issued during the third quarter of 2024. This growth, particularly in relation to the overall increase in Club membership, is a positive indicator. It suggests that users have valued the improved Staking APY. This reinforces the effectiveness of our incentive strategy, which we intend to apply to upcoming features.

It is important to note that YNG’s launch on the decentralised market will accompany a comprehensive restructuring of its tokenomics, which is already underway. As mentioned in the introduction about the “cost” of joining Clubs, the new features we are implementing will offer token rewards in Young (YNG) exclusively for Club members, following a staking model.

The current situation allows us to calculate the amount of YNG available for sale, considering the tokens locked within the Clubs. Approximately 10.2 million YNG are locked in our loyalty programs, representing just under half of the circulating supply. Meanwhile, the amount available for sale is around 13.7 million YNG.

We are confident that our announcements in the coming weeks will further drive Club membership growth. We aim to integrate loyalty programs—and, by extension, our token—more centrally into the ecosystem.

The Price of YNG

Let’s analyse Young (YNG) ‘s performance over the past few months. While the most significant phase of YNG’s recent price surge began in early 2025, we have included this in our report because price movements influence strategic decisions, particularly regarding YNG’s listing on the decentralised market.

At the beginning of December, YNG’s price was around €0.095. This was followed by a gradual increase in buying pressure, initially mild but progressively stronger. Following the release of the roadmap video on December 17 and the start of January, trading volume increased, leading to more robust daily and weekly performance.

On January 18, the announcement of the new Club price rebalancing model gave the market an additional boost. As a result, YNG’s price skyrocketed from around €0.12 to a new all-time high of approximately €0.28, marking a remarkable increase of 158%, with 15 consecutive days of gains.

Following its peak, the token underwent a natural correction, settling around €0.22 due to increased selling pressure. This price retracement was generally anticipated, as it had been advantageous to join the Clubs while YNG was priced below the €0.24 threshold in recent weeks.

Q4 2024: Achievements and Released Features

During Q4 2024, we focused on several key features alongside developments on the token project, which will be covered in a dedicated section. Our primary goal was to introduce the evolution of the Earn feature, which was suspended in 2022.

At the same time, we worked to ensure compliance with the European Markets in Crypto-Assets (MiCA) regulation, which partially came into effect at the end of June 2024, aligning with the new regulatory standards for crypto assets.

As always, this report summarises the progress made over the past three months and provides a detailed overview of the most relevant initiatives and developments.

Expansion of the Staking Feature

At the end of Q3 2024, we introduced staking, initially available only on Ethereum, before gradually expanding to other networks. The second network added to our exchange was Solana (SOL), followed by Celestia (TIA) and Cosmos (ATOM). As mentioned in the Q3 2024 Quarterly Report, this feature aims to provide users with a straightforward and efficient way to earn rewards on their cryptocurrencies without hassle or complexity.

Staking plays a crucial role in this report. It has allowed us to introduce the first significant benefit associated with the Clubs, further enhancing the significance of the Young (YNG) token within the ecosystem.

One of the most significant advantages is the extra YNG bonus, calculated based on the user’s Club level. To determine the actual value of these boosts, simply add the percentage shown below to the standard staking APY, with the increase potentially reaching the maximum indicated, depending on the underlying asset:

- Bronze Club: up to +5%

- Silver Club: up to +15%

- Gold Club: up to +30%

- Platinum Club: up to +70%

In December, we introduced the recurring purchase option for staking. This feature allows users to automate their value accumulation strategy, simplifying asset management while maximising staking rewards over time. For about a month now, users have been able to set up recurring purchases, helping them average the purchase price of the selected cryptocurrencies (ETH, SOL, TIA, ATOM).

This way, they not only optimise their market entry strategy but also maximise the compounding effect of staking rewards, increasing the growth potential of their portfolio.

Club Price Rebalancing Mechanism

Starting today, February 4, 2025, the number of YNG tokens required to join Young Platform’s Clubs will be updated monthly based on the market price. This approach aims to maintain a balance between accessibility for users and the value of the tokens. The adjustment mechanism plays a crucial role in stabilising Club pricing:

- If the price of YNG increases significantly, the number of tokens needed to access the Clubs will decrease proportionally. This prevents the euro cost from rising excessively and reduces the risk of excluding users.

- Conversely, if the price of YNG drops, users will be required to hold more tokens to access the Clubs. This adjustment helps balance the lower unit value and ensures the model’s sustainability.

These mechanisms operate under specific rules to balance accessibility and economic stability and stabilise pricing in fiat currency (euros). Let’s examine how they work.

Amounts to be Locked to Access the Clubs

(Based on YNG’s launch price of €0.24) :

- Bronze: €360

- Silver: €1,200

- Gold: €2,400

- Platinum: €6,000

- If YNG’s price falls below €0.24 at the end of the month, the number of tokens required will increase proportionally, ensuring that the euro cost remains the same as at launch, when YNG was priced at €0.24.

For example, if by the end of the month, YNG is at €0.20, the amount of YNG needed to join the Bronze Club will still be €360, but users will have to lock 1,800 YNG.

Since: 1,800 YNG × €0.20 = €360.

- If YNG’s price rises above €0.24 at the end of the month, a discount factor will be applied to prevent Club access from becoming too expensive.

For example, if YNG’s price increases by 50% beyond €0.24, reaching €0.36, thanks to the discount factor (initially set at 0.5), the euro cost will rise by only half, meaning +25% instead of +50%.

In this case, 1,500 YNG would usually be required to join the Bronze Club at €0.36 per YNG, but with the discount factor, only 1,250 YNG will be needed, meaning €450 instead of €540.

📌 NB: The discount factor may be revised in the future.

In summary:

- If YNG’s price decreases, the required tokens increase proportionally (without discounts).

- If YNG’s price increases, the number of tokens required decreases, but in a controlled way to prevent devaluation of the Clubs.

This system ensures a balanced access model, preventing a sharp price increase from making Clubs too cheap or a significant price drop from requiring an unrealistic number of tokens.

This change guarantees excellent stability and prevents imbalances that could make the Clubs too exclusive.

New Club Prices for February 2025

As previously mentioned, the amount of YNG to lock to join Young Platform’s Clubs in February is as follows (considering the YNG price as of 04/02 at 00:00 at €0.215):

- Bronze: 1,667 YNG

- Silver: 5,557 YNG

- Gold: 11,115 YNG

Platinum: 27,789 YNG

Young Platform Pro Update

Over the past few months, we have been enhancing Young Platform Pro’s trading experience by introducing visual and functional updates to make the platform more intuitive and efficient.

The homepage has been completely redesigned, and the markets page now offers more detailed information for each trading pair, including the 24-hour trading volume and other key metrics. We have also optimised the desktop interface’s adaptability to improve the user experience.

In addition, we have enhanced the data display in the order book, making limit order positions more explicit. The trading pair selector has been optimised to include more information and a more detailed categorisation of available cryptocurrencies. Users can now hide open limit orders and view historical trade positions directly on the chart.

Regarding order management, we have introduced the ability to view individual executed trades. A shortcut for YNG conversion has made accessing small balances (dust) easier. Moreover, shortcuts between the wallet, orders, and trading area have been improved to facilitate smoother navigation.

Finally, we are actively working on releasing a new version of the trader APIs. This version will include WebSocket support, providing advanced users greater automation and integration possibilities.

Zealy Campaign

The Zealy campaign, launched to encourage and reward our community’s engagement, will continue to evolve over the coming months.

After tracking user activity on Discord and rewarding the most active members at the end of 2024, we have kicked off a new campaign, allowing everyone to climb the leaderboard again and win prizes.

The system allows users to earn points through various activities, such as:

- social media interactions,

- themed quizzes,

- active participation in the community.

This initiative is part of a broader strategy to strengthen our ecosystem, where user contributions will be increasingly valued through exclusive benefits.

We will officially announce the prizes during the quarter. They are designed to reflect our ambition to become a digital bank and offer tangible rewards to our most engaged users.

Listing on Young Platform

As always, we have worked to expand the range of cryptocurrencies available on Young Platform, in line with user feedback. During the last quarter, we integrated the following tokens into our ecosystem:

- Popcat (POPCAT)

- Dowifhat (WIF)

- cat in a dog world (MEW)

- Ondo (ONDO)

- Metis (METIS)

- OFFICIAL TRUMP (TRUMP)

- Ethena (ENA)

- Kaspa (KAS)

Would you like to suggest new and exciting cryptos you’d love to trade on our exchange? Join us on Discord! It’s the perfect place to share strategies, discuss results, and ask for advice from other community members.

💬 Join the conversation and stay up to date!

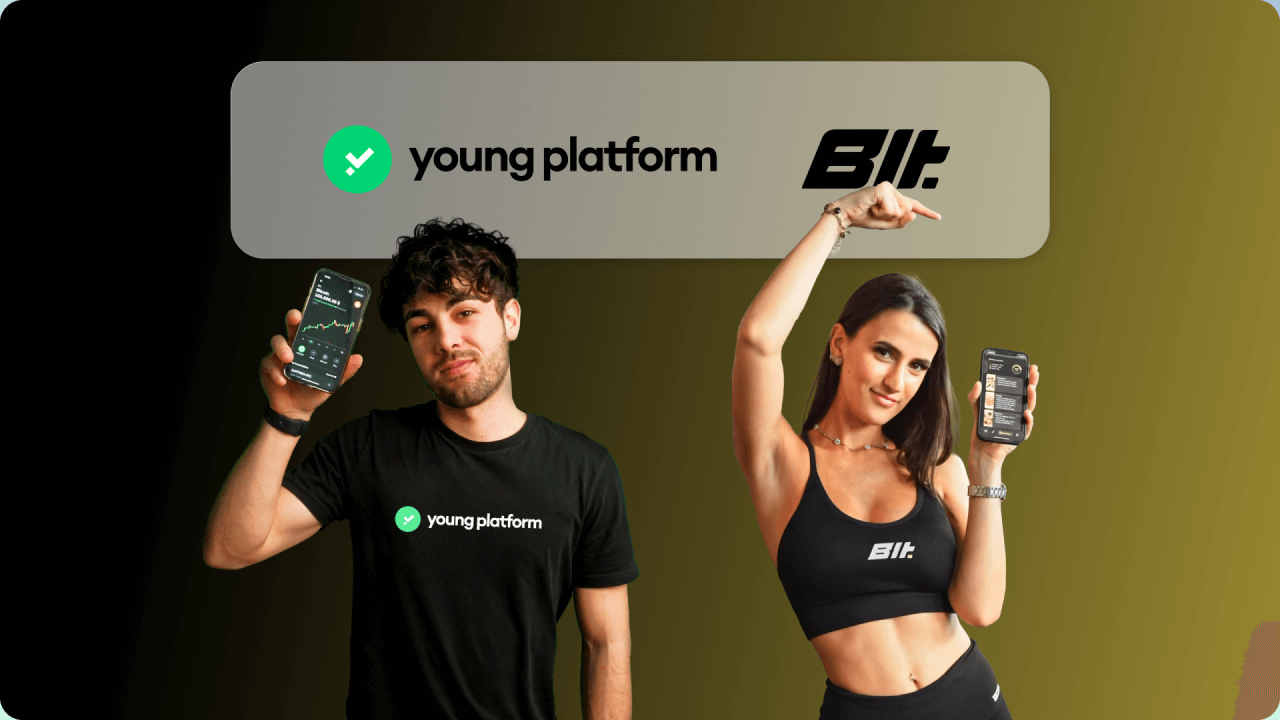

Club Benefits

Over the past few months, we have introduced two new benefits for our Club members in the form of vouchers.

In November, we launched Tiqets, a platform that allows you to explore museums and attractions worldwide without waiting in line. There’s something for everyone, from water activities in Dubai to distilleries in Dublin, stadium tours in London, day trips in Las Vegas, and even visits to the Vatican Museums.

We also recently announced our partnership with Builtdifferent. This all-in-one fitness platform provides personalised training programs and nutrition plans at a significantly lower cost than hiring a traditional personal trainer.

But the exciting news doesn’t stop there! We are discussing with more major brands to offer even more exclusive and valuable benefits in the future.

Stay tuned by following our blog and social media channels so you don’t miss out!

Upcoming News!

The best is yet to come, and here’s a sneak peek.

As previously mentioned, during Q3 2024, we primarily focused on staking and the initial preparations for the payment account. However, YNG remains at the centre of our activities. We have made significant progress and have a clear roadmap for its future. This will be the main focus of this report.

IEO Young (YNG) and Tokenomics

Since the end of Q3 2024, the situation has slightly shifted, primarily due to Young’s (YNG) recent price surge. The stock has returned close to its €0.24 launch price.

As the Q3 2024 report outlined, the goal until early January was to restore YNG to its original launch price through a pre-TGE buyback. This strategy aimed to rebalance existing liquidity pools and establish a solid price base for the token ahead of its official launch on the decentralised market.

Once the price stabilised, the plan was to sell YNG tokens to selected venture capital (VC) firms through a private sale with a structured four-year vesting period. This approach was designed to attract strategic investors who could support project growth. The funds raised would strengthen the treasury, finance development initiatives, and continue the buyback strategy.

However, the recent price increase allows us to explore alternative strategic options while continuing discussions with key European VCs. At the same time, our integration with the selected Initial Exchange Offering (IEO) provider is nearing completion. The team also evaluates the optimal launch strategy, considering market conditions and institutional investor interest.

Our goal remains to maximise the ecosystem’s value by ensuring sustainable token distribution. Additionally, we aim to activate the trading pair on decentralised exchanges (DEXs) no later than the launch of the payment account and card, which is currently scheduled for Q2 2025.

Key Mechanisms to Ensure Token Stability

Beyond the sales strategy, two essential mechanisms outlined in the Q3 2024 report remain active to ensure YNG’s stability:

- Club Rebalancing: The number of YNG tokens required to join the Clubs will be periodically adjusted based on price fluctuations. If the price rises, the required number of tokens will decrease by 50% relative to the price increase. If the price falls, the number of tokens needed will increase proportionally. This system maintains a balance between accessibility and market stability.

- Liquidity Addition: The treasury will monitor the available budget and YNG reserves monthly to add liquidity to the pools. This mechanism, which will take effect with the launch of the DEX trading pair, will help mitigate price fluctuations and ensure greater market depth.

Trade Rumble: The Ultimate Trading Competition

Starting 7 February, we’re launching Trade Rumble, the competition that tests your trading skills, giving you the chance to climb the leaderboard and win amazing prizes.

Joining is simple: trade Euro-Crypto and Crypto-Crypto pairs, complete missions, collect Gems, and rise in the rankings.

Up for grabs: MacBook Pro, iPhone 16, AirPods Max, and many more prizes, with an exclusive advantage for Club members: in case of a tie, the winner will be whoever belongs to the highest Club level (plus, Club members already save on trading fees!).

Account & Card

As previously announced in our last report and during the dedicated AMA, our ecosystem is on the verge of a significant advancement with the launch of the Payment Account and Card, scheduled for Q2 2025. This project has long been a part of our long-term vision and represents the second pillar of Young Platform, bringing us closer to achieving our goal of digital banking.

Our ambition is clear: to become Italy’s first crypto-native bank, combining the strengths of traditional finance with the efficiency, speed, and earning potential of the crypto world. This new approach will offer users a more accessible, faster, and cost-effective way to manage their finances, providing complete control over digital and traditional assets.

The new Payment Account allows users to manage their finances in one place, simplifying spending, investments, and transfers. Additionally, the Debit Card (available in digital and physical formats) will allow users to spend their funds and profits from crypto investments directly, minimising costs and enabling instant transactions. This card will be more than just a payment method—it will serve as an essential extension of the Young Platform ecosystem.

The Clubs and the Young (YNG) token will be crucial in this transformation. Our Crypto-Infused Finance model will incorporate YNG cashback and exclusive benefits for Club members, making our system even more rewarding for those who support our vision. Some of these perks will be available soon, even before the official feature launch.

We are also developing a pre-launch marketing campaign for the Card to reward our most active users. This will be a competition, and Club members will naturally have additional advantages.

That’s all we’re revealing for now… but stay tuned on our social channels to learn more soon!

Futures

We are excited to announce a significant new feature to our ecosystem: Futures on Young Platform, which will launch in Q3 2025. Our community has highly anticipated this development, which represents a strategic evolution of our platform and will expand trading opportunities for all users.

With the introduction of Futures, users will have access to advanced tools to trade with leverage on cryptocurrencies, stocks, and ETFs. This means they can open long and short positions, enabling more flexible and diversified trading strategies—whether to capitalise on bullish trends or hedge against market uncertainty.

The launch of Futures marks a significant milestone for Young Platform. It positions us as a comprehensive hub for managing and investing in digital and traditional assets. This new feature will enhance our platform’s competitiveness, catering to experienced traders and those who want to explore more advanced financial instruments gradually.

That’s all the information for now! Be sure to follow us on all our channels.

Information regarding the YNG Token is for informational purposes only. The Token does not represent a financial instrument. The purchase and use of the YNG Token involve risks and must be carefully evaluated. This does not constitute a solicitation for investment, nor a public offering under Italian Legislative Decree no. 58/1998.