FTX founder Sam Bankman-Fried was arrested last night in the Bahamas. What happened? What will be the next developments?

FTX founder Sam Bankman-Fried was arrested on the morning of the 13th of December (at 5:00 a.m. GMT) in the Bahamas, at his residence in Nassau. Local police forces detained him one day before his testimony before Congress that was scheduled for Wednesday the 14th December 2022. It is now likely to be canceled. But why was SBF arrested today specifically, after weeks of being left free?

There are two main hypotheses. For some, the arrest comes with the fear that Bankman-Fried might move to a country where the US could not extradite him. Others speculate a connection with new allegations made by Do Kwon that were picked up by the media. They concern a possible involvement in the collapse of the Terra (LUNA) ecosystem.

According to the New York Times, there are five charges for the founder of FTX: wire fraud, conspiracy to commit wire fraud, securities fraud, conspiracy to commit securities fraud, and money laundering. What will be the next developments? Will Sam Bankman-Fried’s collaborators Caroline Ellison and Sam Trabucco also be arrested soon? Are SBF and Alameda Research really responsible for the collapse of the Terra-LUNA ecosystem?

What will happen now to Sam Bankman-Fried and his co-workers?

After being ‘at large’ for quite a long time (it has been about a month since the FTX exchange declared bankruptcy on the 11th November 2022), as of yesterday morning, Sam Bankman-Fried is being held in custody in a Bahamian prison. The FTX founder’s arrest came at the request of the US government, which plans to extradite him to a US federal prison.

Commenting on the incident, the Bahamas Prime Minister Philip Davis said: ‘The Bahamas and the United States have a common interest in holding accountable all individuals associated with the FTX failure who may have betrayed the public trust and broken the law.

In these first hours after the arrest, uncertainty reigns. It is not yet clear how many years in prison SBF faces, just as it is not yet known whether he will testify before the US Congress tomorrow as scheduled, although this seems unlikely.

Another question on the minds of many concerns the future of Sam Bankman-Fried’s associates, Caroline Ellison and Sam Trabucco. For the two, respectively CEO and co-CEO of investment fund and market maker Alameda Research, the same fate is probably in store. In the meantime, statements by the FTX founder are circulating again. A few days ago in an interview, he said was sure that he could not be arrested. On that same occasion, he had revealed his commitment to working on a new project with the aim of returning the money lost to his users.

Was it SBF and Alameda that brought down Terra (LUNA)?

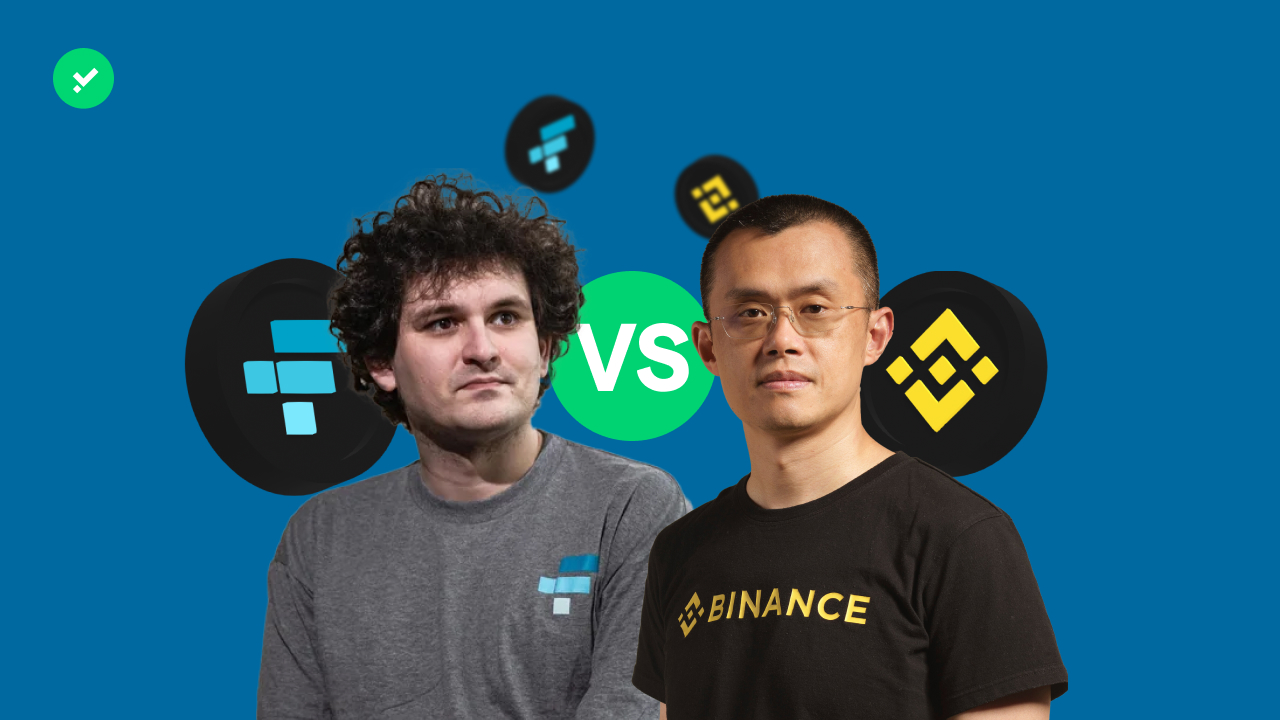

What does Terra (LUNA) have to do with the SBF affair? In recent days, there has been talk about the possible responsibility of Alameda Research in the failure of the ecosystem. Alameda was the trading company founded by Sam Bankman-Fried, that has strong ties to FTX for reasons linked to fund management. A large amount of these funds were allocated to FTT, the token of the FTX exchange.

According to these allegations, Ellison and Trabucco’s hedge fund allegedly attacked Do Kwon‘s blockchain in order to destroy its competitor: Three Arrow Capital (3AC). They were heavily exposed to the blockchain’s two main assets: the LUNA crypto and the UST stablecoin.

The accusation, which originated from former Terraform Labs CEO Do Kwon and Three Arrow Capital co-founder Su Zhu, has not been ignored by US prosecutors. They have launched an investigation that will result in a market manipulation charge against Bankman-Fried and Alameda Research. Should evidence be found of Do Kwon’s and Sun Zhu’s allegations, the charge of market manipulation could be added to SBF. This would aggravate the legal situation of the FTX founder in no small measure.

There is currently no conclusive evidence to support these allegations. The investigation by the US government will shed light on the facts as it takes course. In short, as of today, there are very few certain answers. Many questions about the future and past of the former FTX CEO remain.

The opinion of crypto Twitter

Meanwhile, on crypto Twitter, all hell has broken loose. Thousands of users are rejoicing and making sarcastic comments about the FTX founder’s arrest. Some wonder how many years in prison he will have to serve, and how he will pay for a good lawyer.

In particular, the crypto Twitter users are summoning the extraordinary lawyer Saul Goodman, star of the series ‘Better Call Saul’. He is the only one, according to them, capable of saving the defendant.

Nothing is sparing SBF in the world of crypto Twitter. A series of tweets have also surfaced that bring up his alleged relations with the US Democratic Party.

Bankman-Fried had secretly given donations to Joe Biden’s party during the election campaign of late 2020 and early 2021. These tweets underline the strange timing of this arrest. Perhaps his statement under oath to Congress could have been quite uncomfortable.

In light of recent events, the plot of the movie that Apple plans to produce is also thickening. Now that he has been arrested, will Sam Bankman-Fried be convicted? Is the founder of FTX really involved in the collapse of Terra (LUNA)? And what will happen to Caroline Ellison and Sam Trabucco?