The events of Pride find a home in the Metaverse, Polygon announces it has made MATIC a crypto green and Pharrell Williams is hired by an NFT collection!

Our final edition Young Monday for the month of June? If that’s the case, then we absolutely need to report on the crypto initiatives of Pride month! In fact, the most interesting news of the week takes us to the main metaverses and their events to celebrate the LGBTQ+ community. You will also discover the incredible sustainability milestone reached by the Polygon network, the blockchain expansion of eBay e-commerce and Pharrell Williams’ new career in the NFT industry!

NYC Pride marches in The Sandbox and Decentraland

On the 26th of June in New York, the streets were swept by a wave of Pride, which annually attracts up to 2 million people, and is the largest event for the LGBTQ+ community in North America. This year, NYC Pride went outside these continental borders to march all around the world, but how so? By making use of the Metaverse! Thanks to LGBTQ+ associations organising Web3 events, The Sandbox and Decentraland, the rainbows of Pride shine brightly in the metaverse. One of these associations is MetaPride Land. According to its founder Matt Stevenson, a former Time Magazine executive, the metaverse is ideal for building a community that is unaffected by geographical limitations: “there are still 68 countries in the world where it is illegal to be gay. In the US, there are over 200 bills targeting our community in one way or another. I felt it was really important that this June we provide an accessible space, no matter where you are, to come out and celebrate your life“. Concretely, a collection of inclusive avatars will be presented at The Sandbox, and People of Crypto, another of the Web3-related realities, unveiled ‘The Valley of Belonging’ on 24 June, a project to promote work in the minority metaverse.

In Decentraland, however, Pride-related events are organised by Cash Labs. The ultimate goal behind this expansion of Pride in the Metaverse is to be able to give visibility and space to the Queer community all year round, not just in June.

Polygon is officially a carbon-free network

On 21 June 2022 in its official blog, the Polygon project announced that it had reached its goal and had become a 100 percent carbon neutral network. Last April, Polygon had published its Green Manifesto pledging to make MATIC a fully-fledged green cryptocurrency. Carbon neutrality was achieved with the purchase of $400,000 in carbon credits representing 104,794 tonnes of greenhouse gases, or all the CO2 Polygon has emitted since its inception. Carbon credits are tokens of the on-chain carbon market whose purchase finances green initiatives. This was achieved thanks to the collaboration with KlimaDAO, which analysed the energy footprint of the network especially concerning staking and smart contract operations.

Polygon’s Green Manifesto also includes the allocation of $20 million for green projects on its network such as Bull Run Forest Conservation to protect forests in the state of Belize or the Ghani Solar Power Project, a renewable energy generation project in India. On 13 July Polygon will host the Green Blockchain Summit, dedicated to ‘Web3 leaders to develop solutions to the most pressing environmental problems facing the blockchain industry’.

eBay buys an NFT marketplace, its expansion on the blockchain continues

eBay has acquired KnownOrigin NFT marketplace, with the aim of expanding further into the world of blockchain technology and digital collectibles. The deal was finalised on the 22nd of June but negotiations remained confidential. KnownOrigin was founded in 2018 in Manchester and allows people to create, buy and sell NFTs on the Ethereum blockchain. Jamie Iannone, CEO of eBay, said, “eBay is the first stop for those around the world looking for the perfect hard-to-find or unique item to add to their collection, with this acquisition, we will remain a leading site as our community adds more and more digital collectibles.”

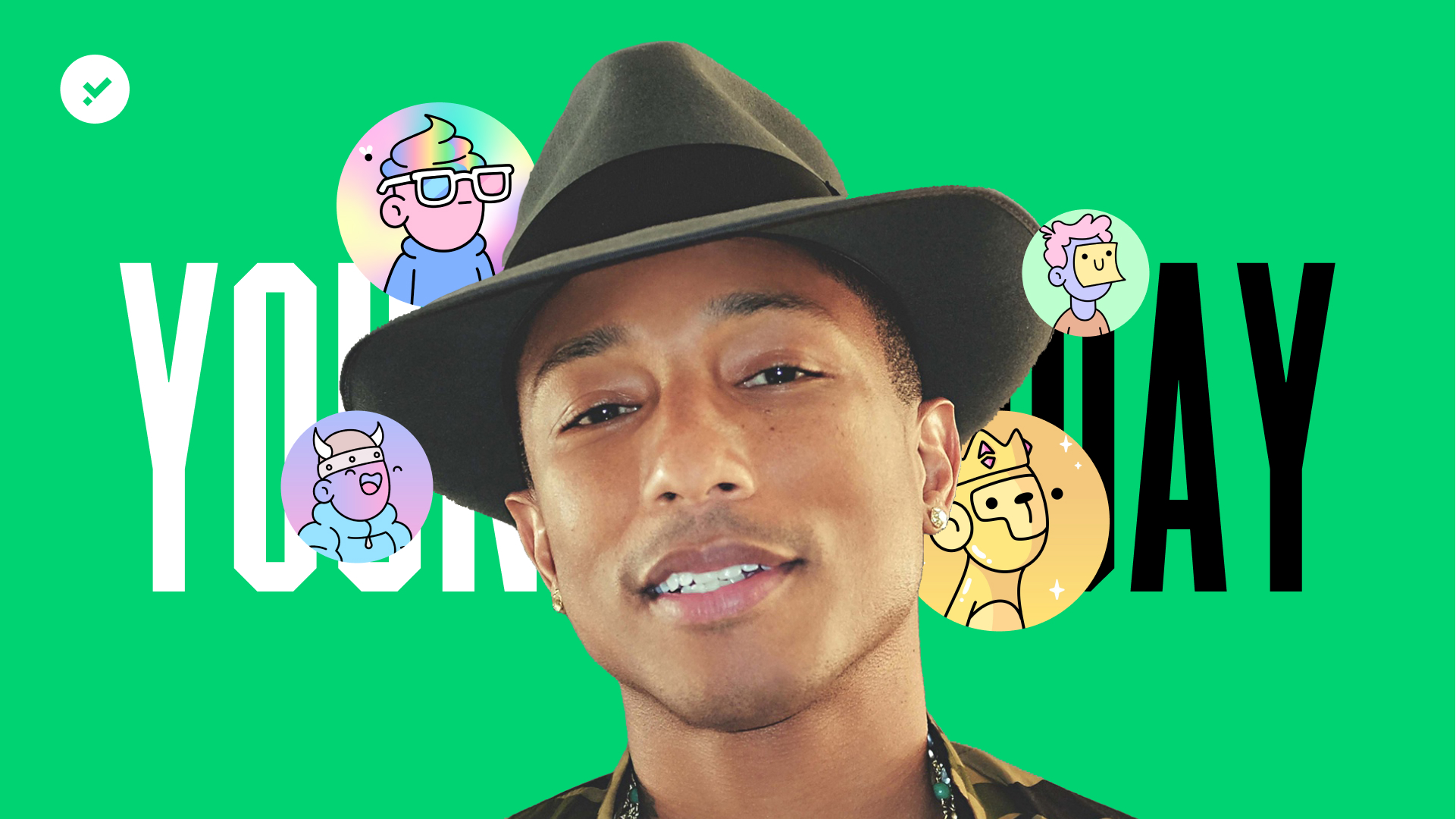

Pharrell Williams is now a consultant for Web3

The artist and record producer Pharrell Williams has joined the Doodles NFT project as Chief Brand Officer and board member. Williams will take care of partnerships and projects between the Doodles collection and other brands related to events, music, artwork and entertainment. In this regard, a music album dedicated to Doodles entitled ‘Doodles Record: Volume 1’ is already in production, in collaboration with Columbia Records and other leading musicians. Williams explained that Doodles is preparing to become known by mainstream audiences and reach new levels of popularity. Doodles are 10,000 NFTs representing various cartoon-style and pastel-coloured characters. Launched in 2021, the project has quickly become one of the most exciting emerging NFT collections with a trading volume of over $400 million. Doodles recently announced its first funding round led by venture capital firm Seven Seven Six. These two pieces of news have given a boost to the price of these NFTs, within 24 hours their cost has risen by about 10%.