Discover 5 basic finance concepts to better manage your savings

When you hear the word ‘finance’, does your brain immediately reply ‘I’ll never understand it’? As a matter of fact, it is one of the most intimidating topics for people, perhaps because it is rich in concepts or because it is associated with large amounts of money and risks, or even because it is considered an elitist world for a few experts. Finance is nothing more than the management of funds and it also has an impact on your daily life, so to manage your money with awareness, it is important to know the basics. Here are 5 basic finance concepts you need to know.

1. Time value of money

The first of these basic finance concepts is that a sum of money is worth more in the present than in the future. In other words, the value of money decreases over time due to inflation, which reduces purchasing power.

This means that if you keep €1,000 for five years ‘idle’ under your mattress, its value will drop dramatically over time. And at the same time you will lose the possible gains that your 1,000€ would have yielded once invested.

The concept of time value of money in fact shows that if money gradually loses value, the only way to make it grow is by investing and that waiting to do so means missing an opportunity.

This principle is to be taken into account before embarking on any financial strategy. Pension fund managers, for example, consider the time value of money to ensure adequate funds for their clients at retirement.

The time value of money can be calculated using a formula that takes several variables into account: the present value of an amount of money, the time interval, interest and inflation rates.

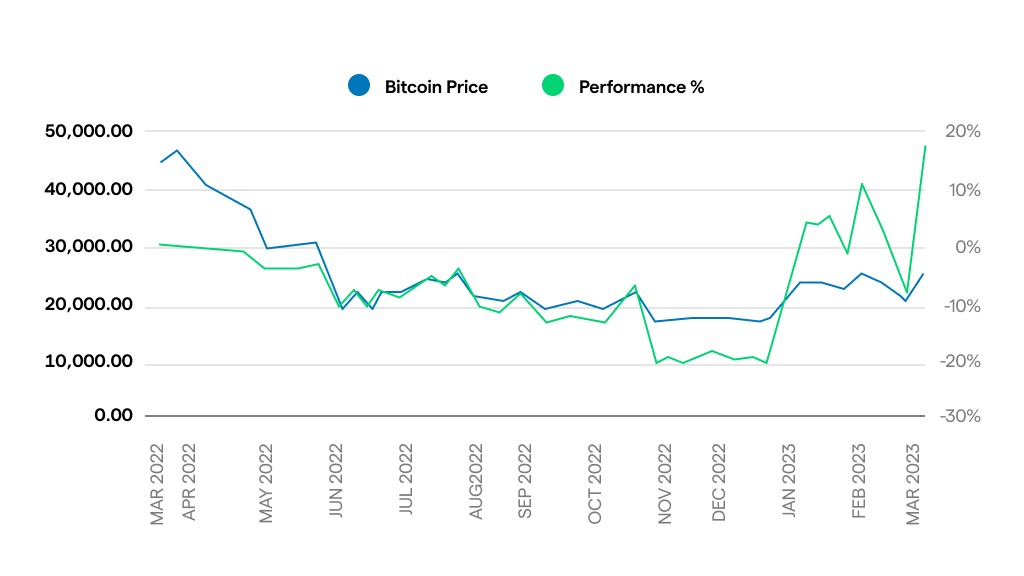

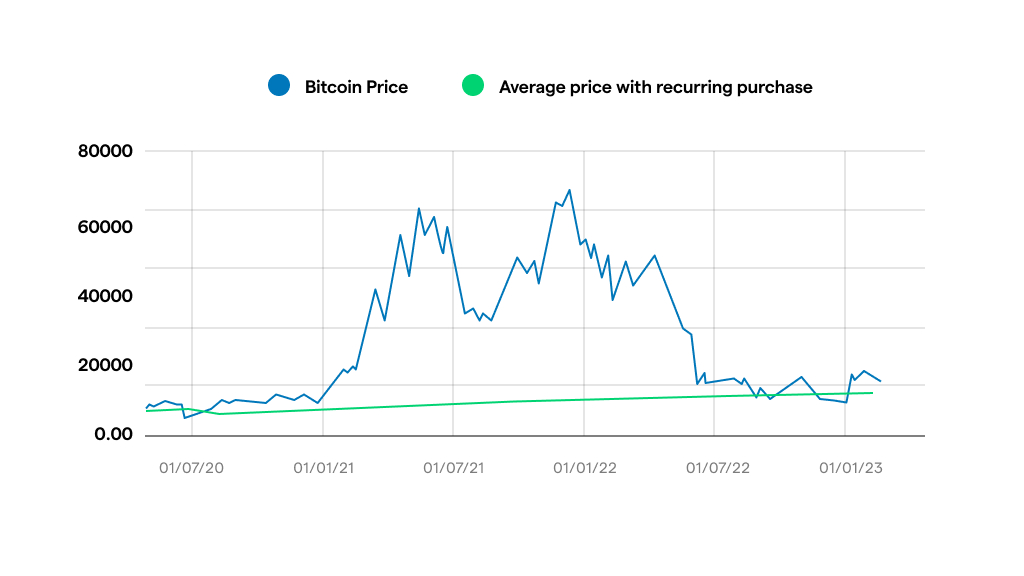

Compared to fiat currency, there are assets that are less subject to the time value of money principle. These include safe haven assets such as gold and commodities because their scarcity increases their value over time, and for some this category also includes Bitcoin (read the research).

2. Diversification

To explain the second of the basic concepts of finance, that of diversification, the image of the basket is often used: the rule is ‘never put all your eggs in one basket, if it falls they will all break’. The idea is not to buy a single asset with your savings to avoid losing everything if something goes wrong. Diversification serves to minimise risk and consists of spreading one’s investments across several assets.

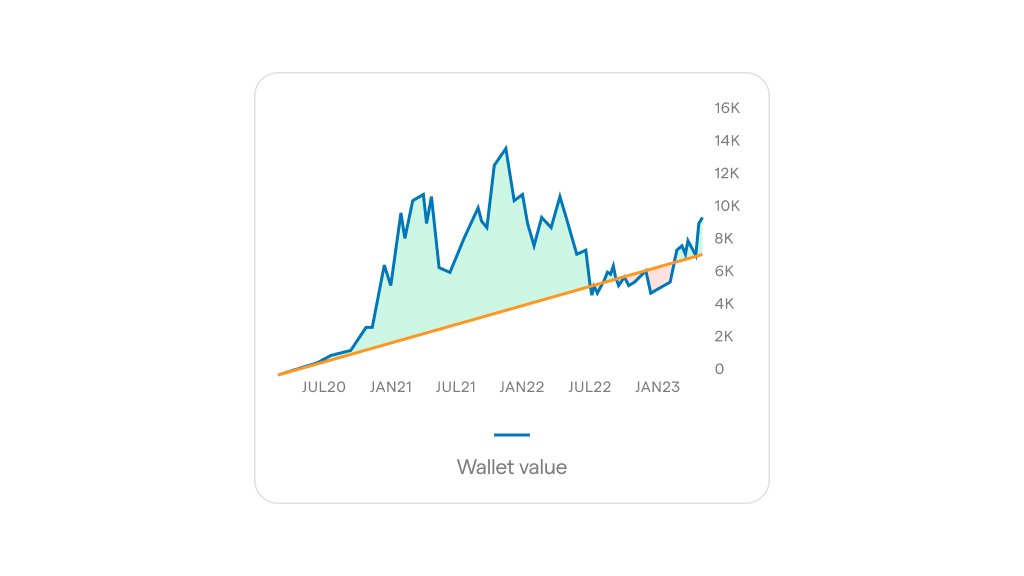

Diversification is also used by crypto users to create a balanced cryptocurrency wallet.

3. Risk/reward

Another of the basic concepts of finance is that of the ‘risk/return’ ratio. This relationship is directly proportional, i.e. the higher the risk, the higher the return and vice versa. In the world of finance, you often hear that ‘There ain’t no such thing as a free lunch’; this expression was popularised by the economist Milton Friedman among others. One cannot have lunch without paying, i.e. in order to have high profits, one must be willing to take risks.

4. Interests

Interest is a fundamental component of finance and represents the cost of borrowed money or the gain from a deposit. In a loan, interest represents the amount of money the lender charges the borrower for lending him/her the money. They are usually expressed as a percentage and are paid together with the repayment of the principal (i.e. the amount of money lent) at set intervals, e.g. monthly or annually.

In an investment, on the other hand, interest is the profit earned over a period of time. For example, if you deposit money in a bank account that offers an interest rate of 2% per annum, you will earn 2% on the money deposited each year.

When considering whether to take out a mortgage, looking at the interest rates is crucial. These can be influenced by the monetary policies of the European Central Bank, which decides on interest rates, which then fall on the commercial banks.

5. Put your money at work

Of all the basic concepts of finance, this refers to the idea of embarking on a strategy in order to grow one’s savings and thus achieve a return.

In this way, the money ‘works’ for you, producing results. Obviously every investment has its risk component, the idea behind ‘putting your money at work’ is to try to get a higher return than you could get by simply keeping your money in a bank account or under your mattress.

In summary, ‘put your money at work’ is an invitation to consider investing as a way to grow your money and achieve your long-term financial goals.

These were the 5 basic finance concepts worth knowing. Not as incomprehensible as you thought, right?