Want to transfer Ethereum and your other cryptocurrencies to Young Platform? Here is the complete guide!

If you want to transfer Ethereum or other cryptocurrencies from external wallets or other exchanges to Young Platform, read this step-by-step guide!

1. Select the crypto you intend to deposit

The first step in making a crypto deposit on Young Platform is to select the cryptocurrency you wish to deposit. To select it, simply go to the ‘Wallet’ section of the Young Platform app or web platform and click on the ‘Deposit’ button.

For this guide, we will use Ethereum as an example. In case you need to deposit a different cryptocurrency on Young Platform, don’t worry! The procedure remains the same, with one small addition. In some cases, as explained in the following paragraphs, you will have to add an extra code, the memo.

2. Copy your wallet address

Once you have selected the crypto you wish to deposit, click on the deposit button. You will then see a similar screen to the one below. Let’s use Ethereum as an example.

The alphanumeric code you see when accessing this section in person is the address of your Ethereum crypto wallet on the Young Platform exchange.

What is the wallet address? It is a code of 26-35 alphanumeric characters, needed to send crypto to a wallet. The wallet address has a similar function to the IBAN code for a bank account. It must therefore be communicated to the sender in order to receive cryptocurrencies.

To transfer your Ether from a self-custody wallet or another exchange, simply send the desired amount of ETH to this address. If you’re using the mobile version of your wallet, you can also scan the QR code displayed above the wallet address.

Use the address you find in “Deposit Ethereum” only to send ETH. Each cryptocurrency has one or more reference networks (for ETH, USDC, and USDT) and a specific wallet address. For example, you can also deposit Ethereum through various Layer-2 solutions such as Arbitrum, Optimism, Linea, and Base. Deposits for the aforementioned stablecoins are available on the following networks:

- USDT: Polygon, Arbitrum, Optimism, BSC, and Tron

- USDC: Polygon, Arbitrum, and Optimism

Always check which networks support the cryptocurrency you want to deposit before making the transaction. For example, sending AVAX, the native token of the Avalanche blockchain, to your Ethereum address may result in the loss of your funds.

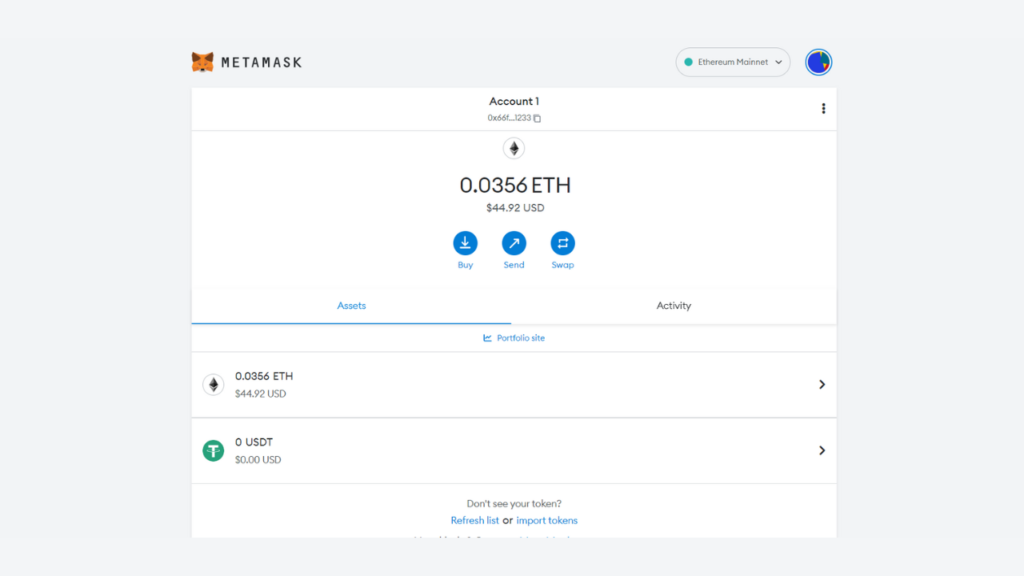

3. Deposit your crypto from a self-custody wallet

Let’s see how to transfer crypto to Young Platform from self-custody wallets, i.e. wallets whose private key you manage, such as Metamask. If you are not familiar with Metamask, it is a browser extension and open-source crypto wallet that allows users to interact with Dapps. This wallet, which was initially created to carry out transactions on the Ethereum blockchain, now allows interaction with all the most popular blockchains that are compatible with it. It is possible to use Metamask from both your desktop through the browser extension and from smartphones through the app.

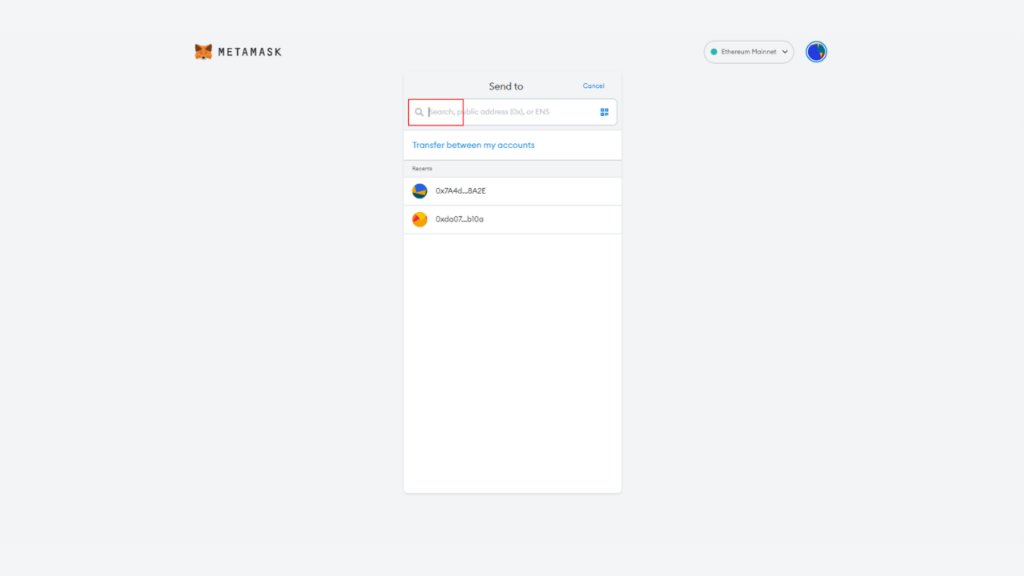

Let’s now move on to the Metamask browser extension. To transfer Ethereum from Metamask ,select the “Main Ethereum Network” from the drop-down list in the top right-hand corner. Then click on the “Send” button

Once you have selected that you want to send the funds, simply paste the address copied above and continue.

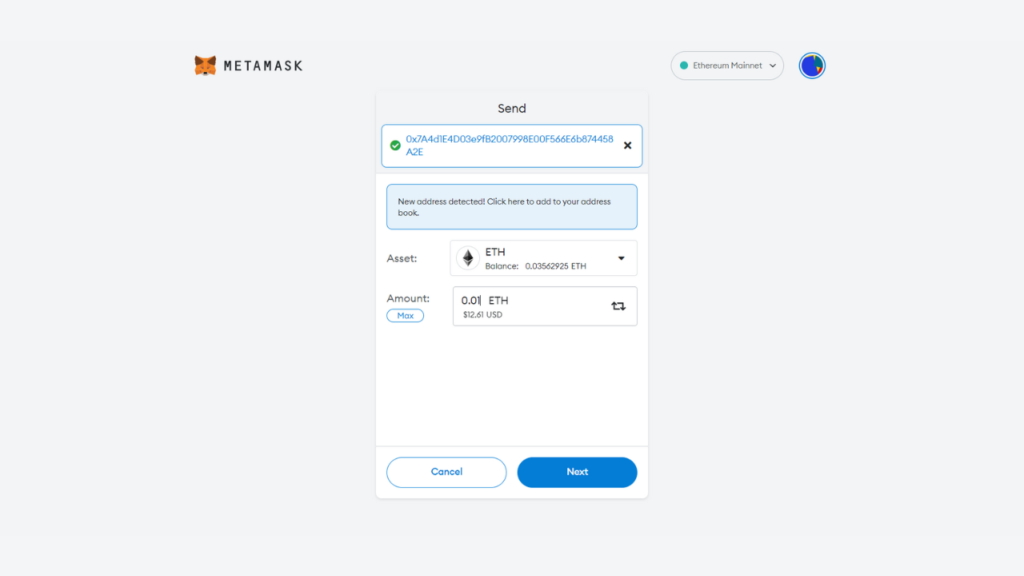

The next step to transfer Ethereum on Young Platform is to enter the amount of Ether you want to deposit. Please note that in order to process a transaction on the blockchain, you need to pay gas fees. They are fees that are paid to validators by those who wish to make a transaction on the blockchain, to ensure that transactions take place securely on the network. So, make sure you have the necessary amount of Ether on Metamask to pay these gas fees, or the transaction cannot be processed. You can see the real-time gas fees. The more congested the Ethereum blockchain is, the higher the fees will be. In addition, the amount of gas fees you pay will be directly proportional to how fast you want the transaction you send to be. You can choose the type of transaction by clicking on the ‘edit’ button inside the Metamask browser extension before confirming the transaction. For this type of transaction, which does not require high speed, there is a tendency to try and save on gas fees.

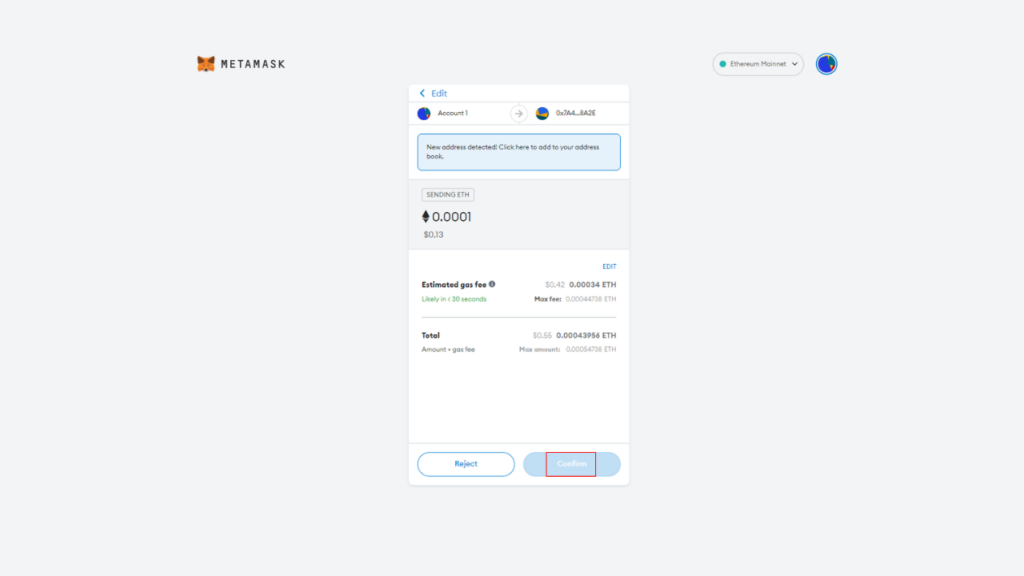

Once you have entered the amount you intend to deposit into Young Platform, all you have to do is click the ‘Next’ button. Then this screen will open, where you can see the amount of gas fees you will have to pay to process the transaction and the total amount of cryptos you will ‘spend’. Once confirmed, the transaction will be processed.

Within a few minutes, you should receive the amount of crypto sent from your self-custody wallet. If the blockchain network is congested, you may experience delays for crypto deposits. In that case, you may have to wait until the transaction is confirmed. If the crypto is not credited to your Young Platform account, request a ticket from the app or web platform.

4. Deposit your crypto from another exchange

To deposit crypto from another exchange, the process depends on the platform. In most cases, all you need to do is go to the “withdraw” section of your crypto wallet and paste in the address you copied above. One piece of advice we can give you is to read the guides for the exchange you intend to use to withdraw your funds. You can find these guides easily on Google by typing ‘crypto withdrawal (name of the exchange)’. For the Binance exchange, for example, just go to the ‘Wallet’ section, select ‘Withdraw cryptocurrency’ and choose the crypto you want to withdraw.

Then, paste your Young Platform wallet address and select the network you want to use. The “network” refers to the blockchain on which each cryptocurrency is supported. For example, if you want to deposit ETH on Young Platform, you can choose Ethereum, Arbitrum, Optimism, Linea, or Base. If you’re unsure which network to select, ask for help on our Discord channel or contact Support—sending your crypto on the wrong network may result in a permanent loss.

5. What is the memo?

For some cryptocurrencies, for example, XRP, the crypto on Ripple’s blockchain, the memo must also be entered when sending a transaction. The memo or tag is a unique identifier assigned to each account to identify a deposit and credit it correctly to the relevant wallet. When you select the crypto you want to deposit and are given the address to send it to by the app or web platform, you will find the memo if you need it.

6. Deposit finalisation

Once the transaction is confirmed, your crypto deposit on Young Platform should be processed within a few seconds to a few minutes, depending on the congestion and speed of the network you are using. To ensure that your funds have arrived on the Young Platform exchange, visit the Wallet section of your app or Web Platform and check the balance of the crypto you have deposited. If you do not receive your crypto even after hours, you can talk to Support by opening a ticket or ask for help, or ask on our Discord server.

Information regarding the YNG Token is for informational purposes only. The Token does not represent a financial instrument. The purchase and use of the YNG Token involve risks and must be carefully evaluated. This does not constitute a solicitation for investment, nor a public offering under Italian Legislative Decree no. 58/1998.