What is rarity and how can you find the rarest NFTs in a collection? Find out how to use NFT rarity tools!

When you want to buy an NFT, one of the factors to be assessed is the rarity of the token you’re considering purchasing. This is because rarity influences the value of digital works. Usually, the rarer an NFT is, the more expensive it is. Consequently, if you plan to buy an NFT, knowing its rarity could prove to be a great advantage. The rarity level of an NFT can be measured in various ways according to the type of non-fungible token. For PFP collections and NFTs created by generative art systems, this can be done through tools. These are the so-called NFT rarity tools. Find out how to use them to find out if an NFT is rare!

Where to start when assessing the rarity of an NFT

To understand whether an NFT is rare, you must start by considering the type of non-fungible token. To simplify matters, we can divide them into two main categories: digital art produced by the most innovative and prestigious NFT artists and automatically generated NFT PFPs. Artistic NFTs produced by famous artists, such as those of Beeple or the Italian NFT artist Giuseppe Lo Schiavo, are usually unique copies. Because of this, the rarity of such NFTs is primarily determined by the scarcity of the specific digital work piece. Assessing the rarity of these pieces is complex because there are no objective parameters. It would be like asking how rare Leonardo da Vinci’s ‘La Gioconda’ or Botticelli’s ‘Birth of Venus’ are. In this case, rarity is also determined by the prestige of the artist and the beauty and significance of the work.

How to find out how rare a PFP NFT is

For NFTs that belong to PFP collections or that are generated by random algorithms, rarity is calculated in diverse manners, i.e. statistically. Within a PFP collection, some NFTs are rarer than others and this rarity factor is not solely determined by uniqueness, just like for the works mentioned above. In other words, all PFP NFTs are unique, but not all are rare. In this case, the rarity of an NFT coincides with that of the attributes of which it is composed.

These NFTs are composed of a series of traits or characteristics that are randomly combined. Each NFT has a kind of ‘genetic code’ describing these attributes that is inscribed in the token’s metadata. In fact, the latter contains all the information about an NFT, from its transaction history to its attributes. Each of these attributes has its own rarity percentage.

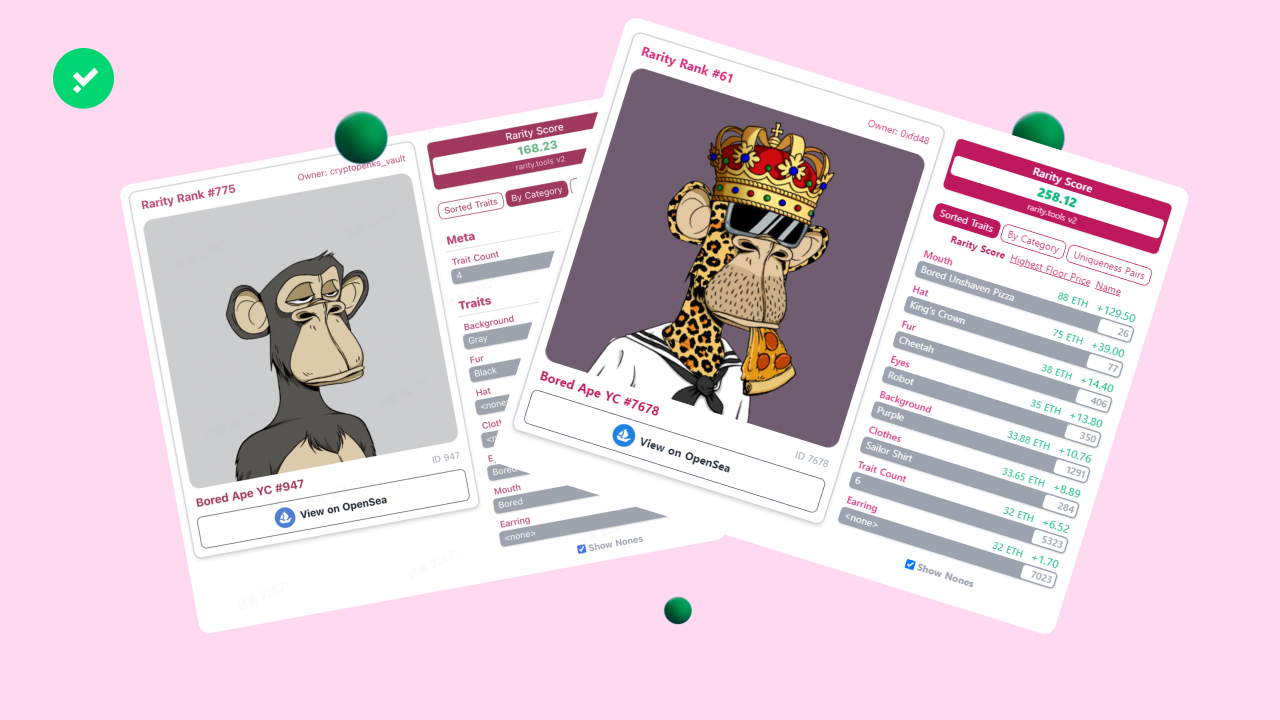

The rarity percentage expresses the amount of non-fungible tokens that possess this characteristic compared to the total number of NFTs in the collection. Take the Bored Apes Yacht Club collection as an example, which to date contains the most expensive NFTs on the market. Among the various traits in the collection (there are a total of 168) are all the aesthetic characteristics that apes possess. For example, whether the eyes are closed or wide open, the Hawaiian shirt or sailor jacket, the diamond or gold teeth. There are only 49 apes that possess the blue beams eyes trait. Since the total number of NFTs in the Bored Ape Yacht Club is 10,000, the rarity of this trait is 0.49%.

Each trait or characteristic contributes to determining the total rarity of an NFT. By adding up the rarity percentage of each attribute, you can roughly determine the total rarity of the non-fungible token. At this point, it may be useful to learn how to find the rarest NFT in a collection. All major NFT marketplaces, such as OpenSea or Magic Eden, grant users the possibility of a filtered search by characteristic. However, to date, they do not allow a collection to be displayed in order of rarity. To meet this need, NFT rarity tools were developed. Let’s find out how to use NFT rarity tools to find out which is the rarest NFT in your favourite collection.

How does a rarity tool work?

Rarity Tools are software programmes that calculate and rank NFTs according to their rarity. In terms of their programming, they are simple databases in which users can search for specific NFTs and see how rare they are within their collection, as well as the characteristics that contribute to their rarity score. With this information, collectors can easily compare the rarity and value of individual NFTs to make informed purchases. Similarly, those looking for a ‘bargain’ can find the rarest NFTs that are offered for sale at a lower price than those with a similar score.

It is important to note that each platform has its own scoring system, so even if the actual rarity rankings are the same across platforms, the rarity score itself will probably differ. Let’s take a look at the 4 most commonly used rarity tools, and how to use them to find out how rare an NFT is.

The main NFT rarity tools

Some of these rarity tools are free of charge and serve mainly to rank NFTs in order of rarity. Meanwhile, others charge a fee and are built for the ‘professionals’ of buying and selling NFTs. Each has its own particularities and is designed for different needs.

1. Rarity Tools

Rarity Tools is the most widely used free rarity tool for finding the rarest and most expensive NFTs on the market.

Scores vary according to the number of different characteristics each collection possesses, e.g. the rarest Bored Ape was given a score of 333.86 while the rarest NFT Azuki anime collection was given a score of 11,096.

On Rarity Tools, you can also filter NFTs by other characteristics besides rarity, such as average price, total sales volume and number of owners. In short, Rarity Tools is a comprehensive tool for delving into which NFT you might want to buy.

On Rarity Tools, it is also possible to search for a specific NFT in a collection by typing its ID into the search bar, i.e. the identification number of the NFT that is usually preceded by a hash symbol. To find the ID of your NFT, simply go to one of the marketplaces where it can be purchased or consult the blockchain explorer of the network on which the NFT was created. For example etherscan.io for Ethereum and solscan.io for Solana.

In the “upcoming projects” section, Rarity Tools presents some of the projects that are about to be launched. To date, the platform only analyses NFT on the Ethereum and Solana blockchains. NFT prices and volumes are calculated in ETH for all collections. NFT collections that want to be included in the “upcoming projects” section of the platform have to pay a fee of 2 ETH. Rarity Tools also takes into account the value that NFT communities give to specific traits. These special traits are called “derived traits” by Rarity Tools, and NFTs that possess them are granted a higher score.

2. Rarity Sniper

The operation of Rarity Sniper is very similar to that of Rarity Tools. The tool started out as a simple Discord server, which users could join for free. Once logged in, you had to type the ID of your NFT in the chat, preceded by a specially created command. Once the message was sent, a bot was triggered by the command, and would give the NFT’s rarity score to the user. In January 2022, the team that ran the Rarity Sniper server decided to develop its own website, which immediately became an institution in the NFT world, reaching one million visitors in less than a month.

3. Rarity Sniffer

Another popular free NFT rarity tool is Rarity Sniffer. Compared to Rarity Tools, this tool allows the rarity of each NFT in a collection to be displayed in no time after its creation. Whereas Rarity Tools needs a few days to register projects within its platform, Rarity Sniper manages to calculate the rarity of an NFT within a few minutes from the moment the metadata is revealed, i.e. the moment it is created (or ‘minted’ in Web3 jargon). Unlike Rarity Tools, it is not possible to filter collections by volume or price. Also, on Rarity Sniffer, it is not necessary to pay a fee to enter NFT collections for analysis.

4. Freshdrop

The fourth rarity tool is Freshdrop. This paid rarity tool allows you to find out if an NFT is rare instantly, beating all other rarity tools to the punch. On Freshdrop, you can inspect the rarity of an NFT at the exact moment the metadata is revealed. The rarity tool takes care of sending the user a notification when the metadata is revealed and then ranks the rarest NFTs in a collection. In order to use the service, the “All Access Pass” must be purchased. It is also an NFT, available on OpenSea at a price of about 0.07 ETH.

Rare NFTs: not just a question of numbers

We have now seen what is implied by the rarity of an NFT, as well as how to tell if an NFT is rare through rarity tools. It is also at this point necessary to specify that it is not only the statistical rarity of traits that determines how expensive NFTs are. Some traits that possess particular aesthetic and symbolic characteristics can become favourites among the Web3 communities and this consequently brings in value beyond mere statistics. For example, the Bored Apes with the golden fur, numbers #8817 and #3749, which are not statistically the rarest, were the two most expensive sales in the history of the collection. They were sold for $3.4 and $2.9 million respectively.

For other collections, it is not sufficient to use the NFT rarity tools. For example, the CryptoKitties collection by Dapper Labs is not present in any of the rarity tools we have seen above. Could it be because the rarity tools can’t stand kittens? Not really, the reason is related to the complex system of attributes, called ‘Cattributes’, and the genetic combinations through which the collection continually evolves.The CryptoKitties are not made up of a fixed number of non-fungible tokens. The NFT kittens reproduce and as a result, Dapper Labs’ collection grows more and more. By combining these ‘cattributes’, genetic mutations sometimes occur that manifest themselves with traits never seen before. NFTs with these mutations are considered among the rarest of CryptoKitties.

Buy ETH on Young Platform