Fed: the complete FOMC 2026 schedule with all upcoming dates

The meeting calendar for the Federal Reserve System (the Fed), the central bank of the United States, includes eight annual meetings. These meetings are similar to those of the European Central Bank (ECB), where crucial monetary policy decisions are made. They are closely watched events because they can significantly impact financial market trends and, in recent years, have become pivotal moments for the global economy.

Fed meetings: what is decided and by whom

Before examining the calendar of Federal Reserve meetings for 2026, let’s first understand how these meetings operate.

The meetings are led by the Federal Open Market Committee (FOMC), which serves as the Fed’s operational body and spokesperson. This committee consists of 12 members, including Central Bank officials and the Federal Reserve Chair.

The FOMC evaluates financial conditions and decides on monetary policy actions necessary to achieve the economic objectives of the United States. Among these objectives, the most crucial is determining the interest rates needed to regulate inflation.

At each scheduled Federal Reserve meeting, a summary of economic projections is presented, known as the Summary of Economic Projections. Additionally, the “Dot Plot” is included, a chart showing the anonymous forecasts of each Fed member for the expected path of the federal funds rate over the past year, in the future, and in the long term. These significant events are marked with an asterisk on the calendar.

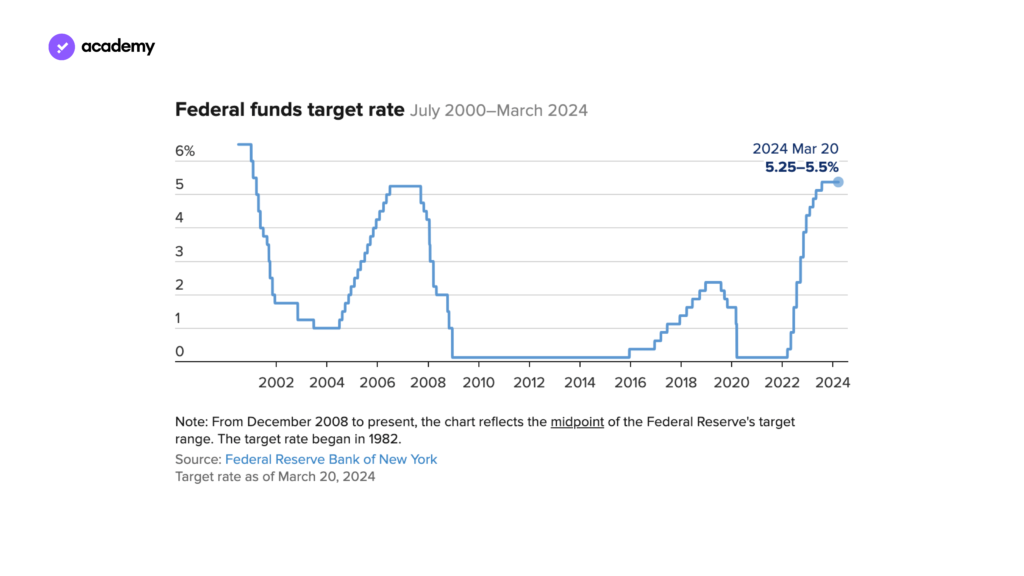

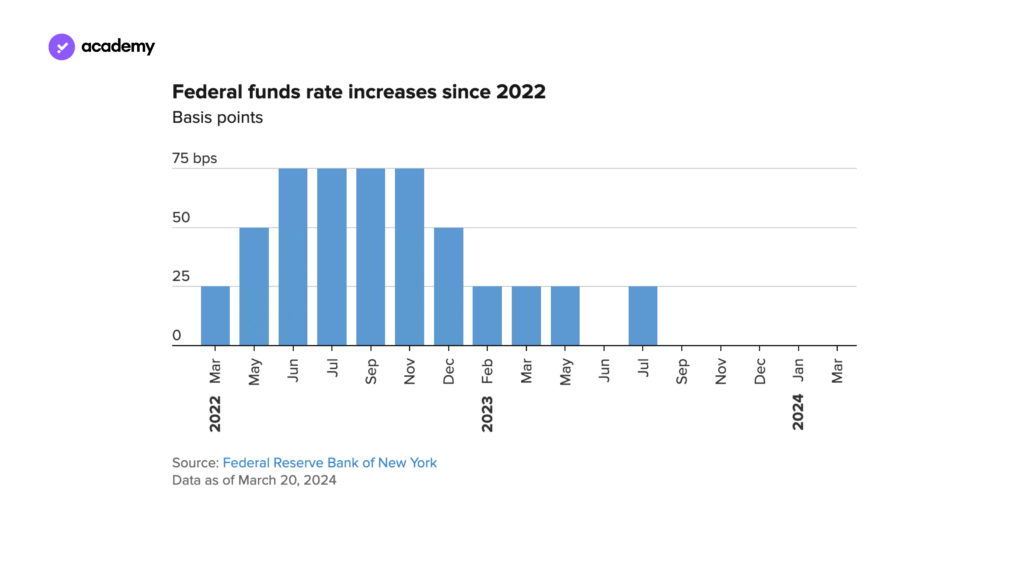

The FOMC meeting announcement

The summary of economic projections is included in the FOMC meeting announcement, a monetary policy statement that outlines key financial indicators, including labour market data. In this announcement, the Federal Reserve also sets the “federal funds rate,” which influences other interest rates, including those for mortgages, loans, and bonds. The federal funds rate is reported as a range (e.g., 1.75%-2%). The implicit target is to achieve an average within this range. A higher target indicates a more restrictive monetary policy, while a lower target suggests a more accommodative policy.

Fed meetings: 2026 calendar

FOMC meetings occur eight times a year, last for two days, and are followed by a press conference with Chairman Jerome Powell. Here is the Fed’s calendar of all 2026 meetings.

- 27-28 January 2026

- 17-18 March 2025*

- 28-29 April 2026

- 16-17 June 2026*

- 28-29 July 2026

- 15-16 September 2026*

- 27-28 October 2026

- 8-9 December 2026*

(*) Meeting associated with a summary of economic projections.

The latest meeting of the Federal Open Market Committee (FOMC) can be accessed through this link, wherein we delve into the recent decision regarding interest rates. We analyse the factors that influenced this decision and the subsequent reactions from the markets, highlighting both the immediate and longer-term implications for the economy.

As we approach May, a significant transition is on the horizon: Chairman Jerome Powell will be concluding his second term at the helm of the Federal Reserve. In light of this development, President Donald Trump faces the critical task of selecting Powell’s successor. Who will emerge as the leading candidate for this pivotal role? To gain insights into the potential candidates and their qualifications, be sure to read the detailed article that discusses the profiles and backgrounds of those being considered for the position.

Fed meetings: 2025 calendar

The Fed met on the following dates in 2025:

- 28-29 January 2025

- 18-19 March 2025 *

- 6-7 May 2025

- 17-18 June 2025

- 29-30 July 2025

- 16-17 September 2025

- 28-29 October 2025

- 9–10 December 2025

Fed meetings: 2024 calendar

The Fed met on the following dates in 2024:

- 30-31 January 2024

- 19-20 March 2024*

- 30 April – 1 May 2024

- 11-12 June 2024*

- 30-31 July 2024

- 17-18 September 2024*

- 6-7 November 2024

- 17–18 December 2024*

Fed meetings: 2023 calendar

The Fed met on the following dates in 2023:

- 31 January – 1 February 2023

- 21-22 March 2023*

- 2-3 May 2023

- 13-14 June 2023*

- 25–26 July 2023

- 19–20 September 2023*

- 31 October – 1 November 2023

- 12-13 December 2023

Fed meetings: 2022 calendar

The Fed met on the following dates in 2022:

- 25-26 January 2022

- 15-16 March 2022*

- 3-4 May 2022

- 14-15 June 2022*

- 26-27 July 2022

- 20-21 September 2022

- 1-2 November 2022

- 13-14 December 2022*

Financial operators and analysts eagerly await Fed meetings. The institution’s decisions play a key role in US monetary policy, but that’s not all.

On several occasions, we have observed an impact on other markets, including the cryptocurrency market. That’s why we’re keeping a close eye on the Fed calendar: sign up for Young Platform so you don’t miss any updates!