We are approaching a pivotal stage in the world of cryptocurrencies: the entry into force of European Regulation No. 2023/1114 of 31 May 2023 concerning Crypto-Asset Markets (MiCA). In particular, the first block of the relevant European legislation will come into force on 30 June, which will significantly impact stablecoins and the broader digital asset market across the European Economic Area (EEA). Specifically, under the MiCA Regulation, authorised stablecoins must meet stricter reserve requirements, governance, and transparency requirements. Furthermore, on 25 June 2024, the Italian government approved the Legislative Decree to align the national regulatory framework with the MiCA Regulation, aiming to ensure coordination with existing sector provisions in Italy (particularly with the TUB and TUF).

What changes for Users?

With the entry into force of the MiCA Regulation, Young Platform is working to ensure that all cryptocurrencies offered on our platform comply with the MiCA Regulation, implementing a series of measures to protect Users and create an even safer and regulated environment.

- Stablecoin: The MiCA Regulation introduces new rules for Stablecoins, which must meet specific requirements to be offered to the public. For reasons better explained below, Young Platform is already working to comply with this new regulation. Still, no changes are planned to the offering of Stablecoins on our platform. We will continue monitoring regulatory developments and guidance from competent authorities and promptly inform Users of any updates.

- Greater transparency (Articles 27, 29, and 40 MiCA): We will provide more detailed information on the cryptocurrencies offered, including associated risks and specific characteristics of each token. In particular, we will focus on Asset Reference Tokens (ART) and Electronic Money Tokens (EMT), for which MiCA establishes specific requirements (Articles 16 and 48 MiCA):

- a) ART Tokens: According to Article 3(6) of MiCA, these are “a type of crypto-asset that is not an electronic money token and aims to maintain a stable value by referencing another value or right or a combination of the two, including one or more official currencies.” The MiCA Regulation requires platforms like Young Platform to obtain written consent from the issuer of the ART token before offering it to the public (Article 16 MiCA) and to comply with specific transparency and communication obligations (Articles 27, 29, and 40 MiCA).

- b) EMT Tokens: According to Article 3(7) of MiCA, these are “a type of crypto-asset that aims to maintain a stable value by reference to the value of an official currency.” The MiCA Regulation establishes stricter requirements for EMT token issuers, which must be authorised as credit institutions or electronic money institutions (Article 48 MiCA) and must also publish a White Paper containing detailed project information (Article 51 MiCA). Platforms offering EMT tokens must also comply with specific rules on communication and marketing (Article 53 MiCA).

- Clear communications (Articles 29 and 53 MiCA): Our communications will be even more transparent and informative, in line with MiCA requirements on marketing and advertising. We will provide all the necessary information to make informed decisions. In particular, regarding EMT tokens, our marketing communications will comply with MiCA’s specific provisions for this type of token.

- Dedicated support: Our Customer Support Team is available to answer any questions or concerns you may have regarding MiCA and its implications.

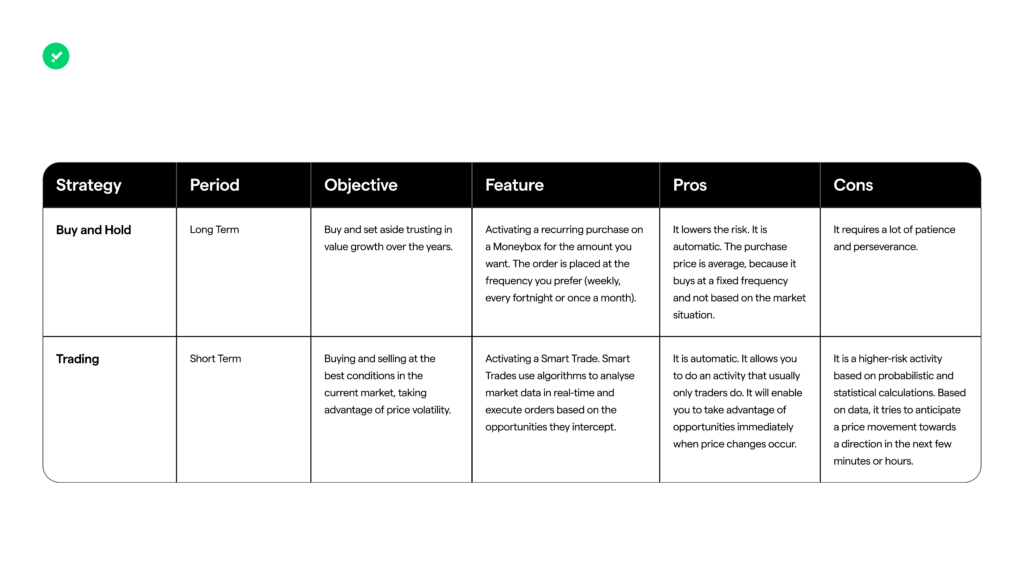

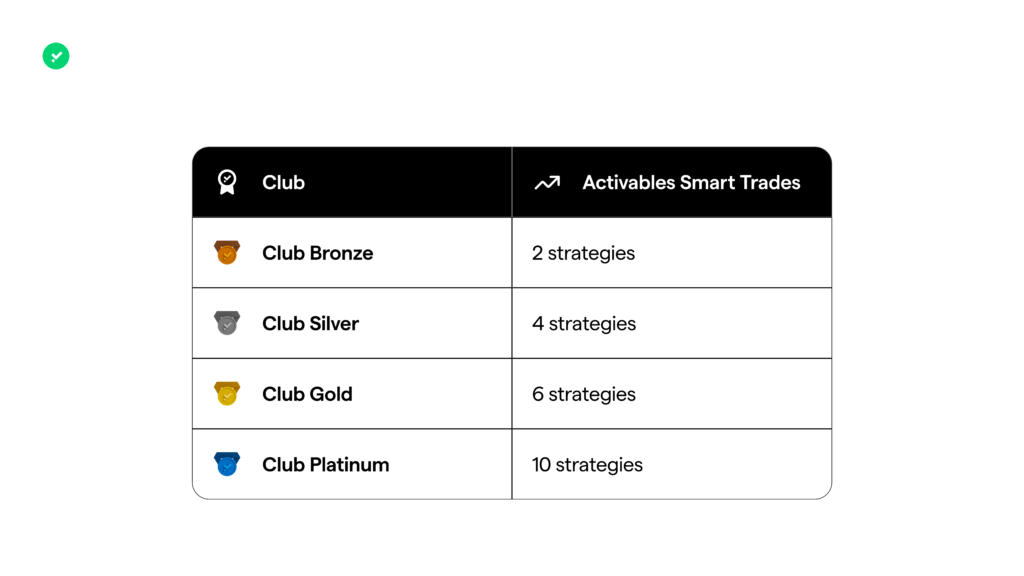

What changes for Spot Trading services, purchasing Stablecoins with Fiat Currency, and Smart Trades?

Although the MiCA Regulation has introduced specific requirements, particularly for Asset-Referenced Tokens (ART) and Electronic Money Tokens (EMT), it does not provide a definitive and exhaustive list of which cryptocurrencies fall into these two categories.

This means that issuers themselves have not openly declared with certainty whether their Tokens should be considered EMT or not. Consequently, Young Platform is in the position of having to independently interpret the regulation and is awaiting definitive clarification from the relevant authorities.

To date, Young is doing its best to contact all Token issuers that may fall into the aforementioned categories, asking them whether they are working to comply with the new obligations for ART and EMT issuers. Due to the absence, as mentioned, of a precise classification of these types of Tokens and considering the various possible interpretations of the regulation, Young Platform has not made any changes to its Spot Trading service for Users or, for the same reasons, to the service of purchasing Stablecoins with Fiat Currency or the Smart Trades service. It should be noted that in the first week of July, we will send Users a new update regarding the classification of EMTs and ARTs, to provide the latest data on issuers who have decided to regularise their Tokens and to specify how these issuers intend to operate. Furthermore, the same communication will further clarify how Young Platform intends to manage Tokens not authorised under the MiCA Regulation.

Certainly, the Company will continue to monitor regulatory developments and guidance from competent authorities constantly, and we will promptly inform Users of any updates and/or changes to the service.

Finally, we invite you to consult the official MiCA summary prepared by public authorities, available at this link.

If you have any questions or doubts, please do not hesitate to contact our customer service. We are here to help you navigate this new regulatory landscape and make the most of the opportunities offered by the MiCA Regulation.