Learn all about Young Platform Clubs: exclusive benefits, membership and the role of the YNG token.

Young Platform Clubs are exclusive benefit packages designed for the Young token (YNG) holders, the cryptocurrency native to the Young Platform ecosystem. Access to these Clubs requires you to block a certain amount of YNG: the more tokens you block, the greater the benefits and the higher the level of your Club.

This article provides all the information you need to understand how the Clubs operate, their benefits, and how the required amount of YNG tokens for membership is determined.

Among the main themes we will explore:

- The Young Token (YNG): Understanding what it is, how it functions, and its primary utilities.

- Young Platform’s Clubs: Discussing the various levels, benefits, and new features introduced with the rebalancing mechanism.

- The benefits for members: Highlighting advantages such as fee reductions and partnerships that enhance the ecosystem experience.

Read the article to discover how Young Platform Clubs can help you optimise your portfolio and access various curated opportunities.

The Token Young (YNG)

The Young token (YNG) is the native cryptocurrency of the Young Platform ecosystem. Developed as an ERC-20 token, it is classified as a utility token and complies with MiCA (Market in Crypto Assets) regulations. YNG is designed to provide value and utility to users and serves as the central element of the Platform’s functionality.

With YNG, users can access Young Platform Clubs, which offer packages of benefits based on the amount of tokens they block. The more tokens a user blocks, the greater their benefits and the higher their Club level. Initially introduced in 2018 as a reward for participating in the Young Platform Step educational game, YNG expanded its utility in 2022 when it was listed on the exchange, coinciding with the growth of Young Platform, now recognised as Italy’s leading crypto exchange.

The token offers concrete benefits, such as increased APY on staking, commission discounts, and priority access to initiatives and promotions. The YNG ecosystem will be further enriched in the coming months with new features, such as payment accounts, cards, and advanced trading tools (e.g., margin trading).

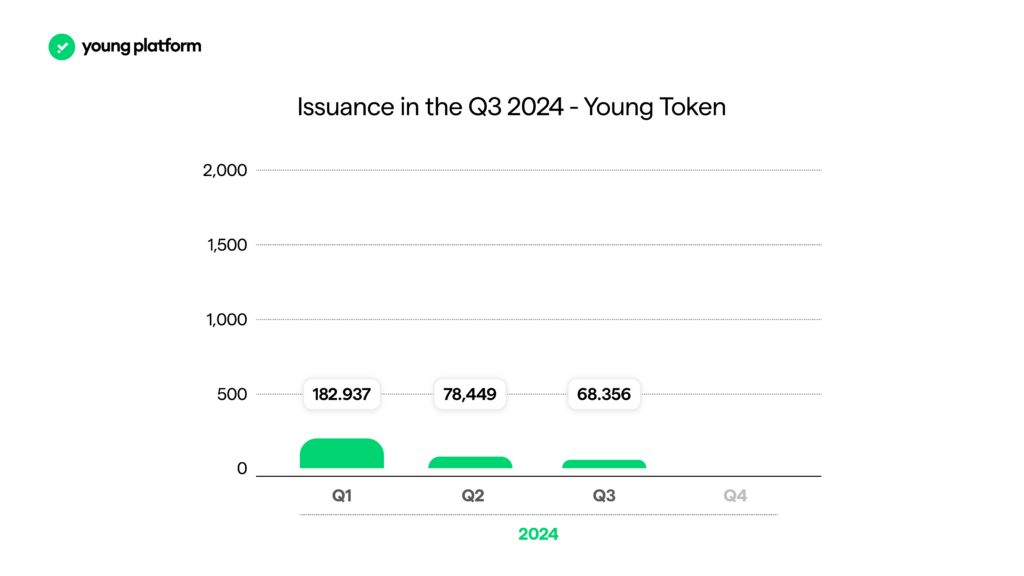

YNG’s tokenomics support sustainable growth, facilitated by buybacks and periodic cash injections made possible through a portion of the ecosystem’s revenues. Users must block YNG within the Young Platform app by signing up for one of the Clubs to access these benefits. The benefits offered by the Clubs are continually evolving as new partners and features are introduced, thereby increasing the value for token holders.

In addition to being a digital asset for portfolio diversification, YNG allows users to actively participate in the growth of the Young Platform ecosystem, creating a direct and incentivising connection between the community and the platform.

The information in this paragraph is intended for informational purposes only and should not be considered financial, investment, or other types of advice. Investing in cryptocurrencies, including YNG Token, carries significant risks, such as market volatility and the potential loss of your entire investment. Before making any decisions, conducting your research, carefully evaluating your financial situation, and consulting a specialist advisor if needed is essential. Past performance is not indicative of future results. Young Platform disclaims any liability for losses or damages resulting from using the information provided in this paragraph.

The advantages of the Club Young Platform on functionality

Young Platform’s clubs provide various benefits aimed at enhancing user experiences and maximising the value of cryptocurrency holdings while minimising costs and increasing potential earnings.

One of the primary advantages is the significant discounts on buying and selling fees, which can reach up to 90%. This reduction in trading costs is especially beneficial for active investors. Additionally, members can take advantage of higher Annual Percentage Yields (APYs) on staking. Not only do they earn rewards in the staked currency, but they also receive YNG tokens. The bonus YNG gains can increase by up to 70%, making this a compelling option for those looking to earn passive rewards through staking.

Moreover, members can earn extra rewards through Airdrops, providing bonuses of up to 25% on standard rewards. A complimentary monthly Market Report offers detailed analysis and forecasts for those seeking insights into market trends. VIP Support ensures personalised and priority assistance for members of the most exclusive clubs.

Traders can also benefit from Smart Trades, which are advanced tools that automate algorithmic trading. They allow up to 10 trades to be executed simultaneously.

On a practical note, the Tax Report helps members manage capital gains realised from cryptocurrency investments, offering discounts of up to 80%. Club members can also make free card deposits, with the number allowed depending on the club level, further reducing operating expenses.

The benefits of Young Platform Clubs with big brands

In addition to direct benefits, the clubs collaborate with major brands to provide exclusive offers. For instance, NordVPN offers up to 78% discounts to protect your online browsing and data. Freename allows you to register customised NFT domains with a credit of up to $220.

For travel enthusiasts, WeRoad discounts up to €450 on group adventures, while Saily eSIM enables you to use 5GB of data to stay connected while abroad. Culture lovers can enjoy discounted access to museums and attractions through Tiqets, with up to 12% savings. For those who are into fitness, BuiltDifferent offers coupons for workout classes, personalised nutrition plans, and more.

Additionally, HelloFresh can deliver fresh ingredients and ready-made recipes for healthy and delicious meals suitable for your home.

The advantages of the clubs go beyond immediate benefits and continually evolve with the addition of new partners and features, making Young Platform Clubs a versatile and constantly improving resource for all members.

To compare membership plans and benefits, please visit the Clubs page.

The price of clubs: blocking, not spending

You do not need to spend your YNG tokens to join Young Platform Clubs. Instead, you simply need to buy them and lock them in your wallet for the duration of your membership. This approach allows you to maintain complete control over the value of your assets, as the tokens remain your property and can be unlocked at any time after your minimum 90-day membership period.

Starting February 4, 2025, the number of YNG tokens required to access the Clubs will be dynamically calculated based on the token’s market price. This system ensures a sustainable balance between supply and demand, making your economic commitment proportional to the actual value of the token. If the price of YNG increases, the number of tokens required will decrease, and conversely, if the price decreases, the number of tokens needed will increase accordingly.

With this solution, Young Platform keeps the Clubs accessible and flexible while supporting the growth of its ecosystem.

How the commission discount works

Young Platform automatically applies a club commission discount to users’ buy and sell orders. This benefit is advantageous for active traders who frequently execute trades and long-term investors, such as those using an accumulation plan with recurring automatic purchases. By reducing transaction costs, this discount helps optimise the overall performance of trading strategies.

The discounts are progressive and vary based on your Club level, ranging from 30% to 90% off commissions. If you qualify for a higher discount than your current Club level, the platform will automatically apply the more favourable rate, ensuring you always receive the best possible conditions.

Commissions are also discounted on Young Platform Pro, the advanced trading platform. These discounts apply to a maximum trading volume of EUR 50,000 over the last 30 days; standard commission rates apply beyond this threshold.

With this flexible and automated approach, Young Platform’s Clubs optimise the experience for every type of investor, making the ecosystem more accessible and convenient. The discount level can be checked by visiting the Clubs section on the site.

Upgrading, Downgrading and Unsubscribing from Clubs

Joining a Young Platform Club is a flexible choice that adapts to your needs and does not require a fixed commitment. You can easily upgrade to a higher level, move to a lower-level Club, or unsubscribe altogether, all while retaining complete control over your YNG tokens.

Upgrade

If you want to access the benefits of a higher Club, you can do so at any time by adding the necessary amount of YNG to meet the minimum requirement for the new level. For example, if you are a member of Club Silver with 5,000 YNG blocked and want to upgrade to the Gold level, simply block an additional 5,000 YNG. This grants you immediate access to the new benefits without waiting for the current membership period to expire, which will automatically renew for another 90 days after the upgrade.

Downgrade

The process is straightforward if you prefer to downgrade to a lower level. After you cancel your Club membership at the end of the minimum 90-day period, your YNG tokens will be unlocked and transferred to your Main Wallet. You can use them from there to join another Club or participate in other trading activities. Please note that once you leave a Club, you will lose all associated benefits, such as commission discounts or staking bonuses.

Unsubscribe

Unsubscribing is also designed for flexibility and simplicity. Once you unsubscribe, your YNG tokens will immediately be available for trading or other uses, but you will lose access to Club benefits. For instance, in the case of staking, you will continue earning standard rewards but no longer receive additional bonuses linked to your membership level.

This system combines ease of management with continuity of benefits, ensuring that Young Platform Clubs are ideally suited to your needs and investor profile. Whether you choose to upgrade, downgrade, or unsubscribe, you always have the opportunity to optimise your use of YNG tokens and make the most of the ecosystem.

You can consult the dedicated guides if you have further questions about clubs.

To look at the YNG Clubs and Token, sign up for Young Platform.

Information regarding the YNG Token is for informational purposes only. The Token does not represent a financial instrument. The purchase and use of the YNG Token involve risks and must be carefully evaluated. This does not constitute a solicitation for investment, nor a public offering under Italian Legislative Decree no. 58/1998.