A retrospective on the start of the year for the YNG token, with an in-depth look at Clubs and the latest news

Let’s take stock of the Young (YNG) token distribution, sales and use cases nine months after its market launch. In this report compiled at the beginning of April 2023, you can find an overview of the clubs, the token’s up-to-date distribution in the first months of the year, and the project’s future goals.

Participation in Clubs

The YNG token is Young Platform’s utility token whose main use case is to grant access to Clubs: subscription plans that offer exclusive benefits within the exchange.

Currently, 1343 people participate in the Clubs, divided into:

- 976 for the Bronze club;

- 196 for the Silver club;

- 112 for the Gold club;

- 59 for the Platinum Club.

To join a Club it is necessary to lock a certain amount of YNG into it, which is why the number of registered members gives us a relevant figure on the distribution of the token: the more YNG are locked (for a minimum of 90 days) in the Clubs, the less it will be sold, and consequently its market price will be sustained. Compared to the last report, the recorded growth of Clubs is +10.6%.

Distribution of the YNG token

The number of tokens in circulation at the end of January was 20.5M. The number of tokens in circulation at the end of March was about 22M, which means that there was a net increase of 1.5M tokens, or 7.3%.

These tokens were distributed via the Young Platform Step app in different ways:

- 13,910.9 through the completion of Quizzes by 28,239 users;

- 1,299,439.24 through the winning of Challenges by 82,702 users;

- 243,275.65 through the use of the Up&Down function by 72,840 users.

The YNG token market is run through an algorithm that defines the exchange rate by means of two underlying liquidity pools, in EUR and YNG respectively. Initially, these pools contained:

- 1M Euro;

- 4M YNG.

Considering the sales and purchases of tokens handled in recent months, the pools contained at the end of March 2023:

- 677.3k Euro;

- 6.17M YNG.

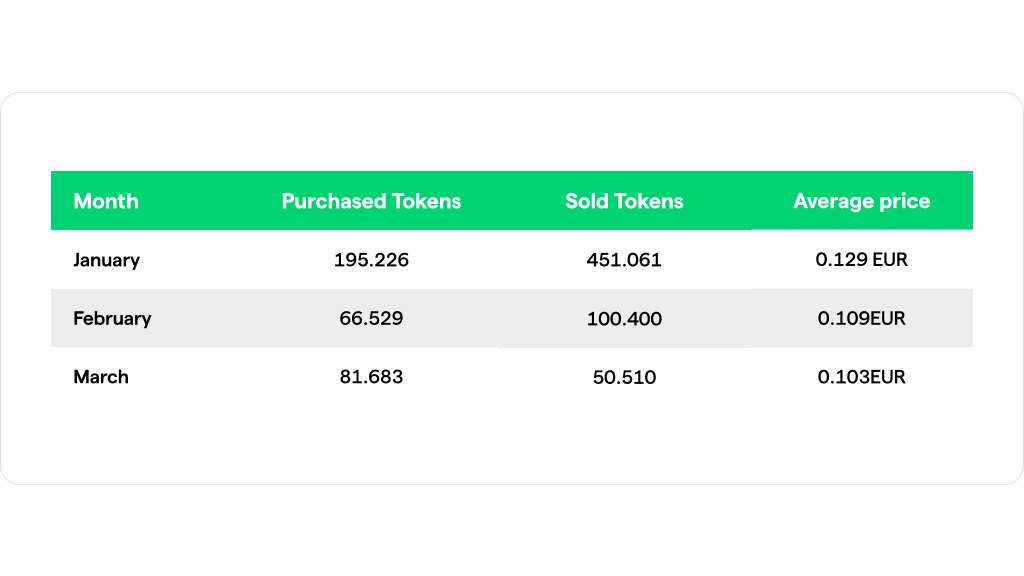

This configuration is the result of purchases and sales during the first quarter, summarised in the table below together with the price trend:

Future Objectives

During this first quarter we released some features anticipated in the previous report, such as free deposits for clubs and the market report.

Other projects, however, are in development: here are the updates.

Airdrop & Voucher

We have officially launched the second coupon distribution campaign, as already anticipated in our last report. The promoter chosen for this initiative is Freename, a cutting-edge platform that allows you to create, buy and sell NFT and TLD domains. As with the previous campaign, we distributed coupons that can be used on the aforementioned platform to all Club members. We are confident that this partnership will help us offer our members the chance to discover new opportunities and make the most of blockchain technologies.

The next quarter will be devoted to planning the next coupon distribution campaign, which we hope to announce soon. We continue to work hard to offer our members access to unique services and promotions to enrich the Club experience and keep their satisfaction levels high.

Token tracking (CoinMarketCap and CoinGecko)

Currently, we are still waiting for a response from CoinMarketCap and CoinGecko for our submission, which is still under evaluation. In the meantime, we are focusing our internal efforts on improving our token information tracking page.

Earning Wallet

The product team is working on the new version of the ‘Earning wallet’ functionality, as already mentioned in our last report. We are devoting special attention to the legal aspects, and if the assessments bring a positive outcome, we expect to release the functionality by the end of this quarter.

Buyback

During the first quarter of this year, we structured buyback operations to boost the exchange and volumes of the YNG token. Specifically, we identified two types of operations to be executed. The first is a “one-shot” buyback operation aimed at rebalancing the amount of EUR allocated to the pool compared to the amount present at the beginning of the year. The second is a mixed operation involving the periodic repurchase of tokens and/or the ‘Burn’ of it.

Specifically, the first model proposal confirmed by the company’s management takes the monthly buying and selling volumes and derives the delta. If the delta (Buying Volume – Selling Volume) is positive, it is proposed to buy through EUR a sum of YNG tokens. Conversely, if the delta is negative, it is proposed to ‘burn’ a sum of YNG tokens. In summary, the plan presented aims to stimulate the exchange and volumes of the YNG token in order to improve its overall performance. These operations will be presented and executed during this quarter and will be communicated on this Blog with the various details.

Club Section of Discord

We are making progress in structuring our server to allow Club subscribers access to a confidential Q&A channel with our team. We are confident that we will be able to test a first version during this quarter.